Summary:

- After a year of high highs and low lows, individuals and governments alike are taking note of the polylithic nature of crypto.

- Crypto provided millions in overnight financial support for Ukraine, made huge legislative gains in the EU and Asia, and saw lots of activity in the US.

- What’s next? Smart policy guardrails and proactive steps towards a shared digital future.

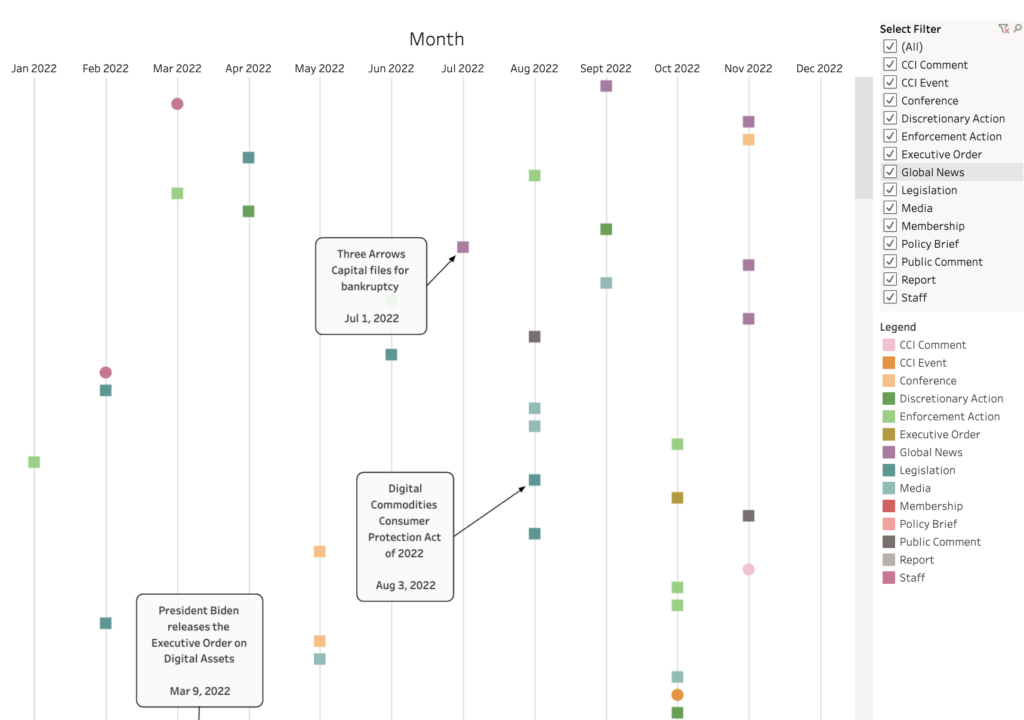

- To help visualize the year that was 2022, CCI put together this interactive timeline layering key policy events, enforcement actions, and legislation on top of global news headlines.

After a year of high highs and low lows, it’s clear that crypto has entered the mainstream. Individuals and governments alike are paying close attention. CCI has compiled a timeline of some of the most significant policy events in crypto in 2022. And it’s indeed been quite a year.

This year’s headlines reflected the polylithic nature of the industry: Over $1 billion being raised rapidly and transparently for COVID Relief in India and $60 million donated in the crucial initial days of the Ukraine war. The crash of Terra – and the associated losses – affecting real people. The Merge, a multi-year decentralized technical project, taking place without incident and significantly diminishing crypto’s overall energy usage. The dramatic rise and fall of FTX and subsequent arrest of SBF.

I won’t mince words: it was a devastating year for many engaged in the industry. I am constantly aware of the people who are behind these numbers and how the greed and irresponsibility of a few leaders in the crypto space affected so many. But we should also be clear that this is what was at the core of the negative headlines: people. As I’ve said before, humans are going to human. The reasons to be horrified by the actions of these few individuals is well-covered territory.

I want to offer a slightly more hopeful take. To me, those headlines reflect – more than ever – the need for and potential of crypto and blockchain technology. And it showed what goes wrong if the correct guardrails are not put in place. It took time, but governments are finally waking up to the reality that crypto is here to stay. The increased activity in the policy and regulation space means that they are taking it seriously. And this is a good thing.

Regulation should disincentivize horrible behavior, make it hard to pull off, and create accountability when some do it anyway. Tech that helps with these goals should be lauded.

Overall trends

I spent my year meeting with policymakers, regulators, thought leaders, and their teams. Many across the political spectrum are working to get up to speed quickly. Those that understand what’s at stake have taken the time to invest in understanding how the space is operating, how it should be guided via policy frameworks, and what’s too new to assess.

Around the world, we see the emergence of digital asset champions, who are eager to attract crypto talent and innovation to their jurisdictions. For instance, the Crypto Council for Innovation recognized nearly 30 members of Congress with the Digital Future Award for their leadership in the United States – and all that were up for re-election in the midterms won their races. The new United Kingdom prime minister, Rishi Sunak and South Korea’s newly-elected president, Yoon Suk-yeol are seen as “crypto-friendly.” Japan’s Prime Minister announced additional investment in Web3 services and the government is experimenting with everything from a DAO to NFTs and the Metaverse.

At the same time, we’re seeing the fruits of dedicated resourcing to crypto and blockchain technology. Those crafting policies and regulations have demonstrated a greater understanding of the diversity we see in crypto projects – especially around how differences in decisions around economic incentive design, governance, and even marketing can lead to vastly different structures and outcomes. We have also seen the entry of high-ranking government officials who are taking the lead in ensuring that crypto grows in the right way.

And the crypto curiosity is extending well beyond the confines of government actors. We have seen everyone from think tanks and academics to luxury brands to commercial banks taking proactive steps towards a Web3 strategy. In fact, significant announcements from well-known financial institutions – including big names like Goldman Sachs, Fidelity, and BNY Mellon – into services such as custody services, wealth management, trading, and research and development have caught the attention of policymakers and regulators alike.

State of Play

Here’s a roundup of some of the biggest developments in policy and regulation this year:

On the international front, standard-setting bodies (SSBs) and multilateral institutions around the world have recognized the importance of collaboration and alignment on this cross-jurisdictional technology. While many of these frameworks have been in development for some time, we saw some significant reports and guidance drop recently. For example, in the last few months, the Financial Stability Board (FSB) released its proposal for the regulation of crypto-assets and stablecoins, the Organisation for Economic Co-operation and Development (OECD) unveiled its crypto tax framework, and the Basel Committee on Banking Supervision (BCBS) published its second consultation on the prudential treatment of cryptoasset exposure.

Crypto in the US

In the United States, President Biden’s Executive Order on Digital Assets – issued in March – catalyzed a flurry of activity from the US regulators. This has included the release of several reports and an overarching framework that came out of report findings. On the legislative side, there has been a significant amount of activity, with over 50 digital asset-focused bills introduced by August 2022. A few examples include the Bipartisan Responsible Financial Innovation Act proposed by Senators Lummis and Gillibrand, which aims to provide a comprehensive framework for digital assets, the Digital Commodities Consumer Protection Act, which gives the CFTC new tools and authorities to regulate digital commodities, and stablecoin proposals on both the House and Senate sides. While the ultimate fate of the bills remains unclear, this activity demonstrates the growing importance of the conversation in the US. At the same time, it was a year that saw many enforcement actions from both the SEC and CFTC. A challenge for the United States remains navigating the complex and fragmented landscape of financial regulators in the country.

Crypto in the EU

The EU made headlines with its passage of the Markets in Crypto-Assets (MiCA) Regulation and accompanying Transfer of Funds Regulation (TFR). Years in the making, this package represents the most comprehensive legislation that has been adopted in the world to-date. It covers a range of areas, including crypto-assets, stablecoins, and crypto-asset service providers (CASPs). As such, it’s a landmark deal that put the EU on the map as an early and important leader in defining the regulatory environment. However, the devil is in the details – and this next phase has involved figuring out the practicalities of implementation. Importantly, while MiCA and TFR have made the most news, developments within the EU’s Digital Markets Act (DMA) and Digital Services Act (DSA) – which seek to regulate online platforms and services – will have significant implications for crypto players as well.

Crypto in the UK

The United Kingdom has had a tumultuous year with three prime ministers in three years and unprecedented economic conditions. This threw a wrench in their plans to become a global crypto hub, announced in April by then-Chancellor Sunak. Now that the political situation has stabilized, the country looks on track to make significant progress on a policy framework, expected for consultation later this year or early next.

Crypto in Asia-Pacific

In the Asia-Pacific region, countries have been taking significant steps as well. While mainland China has embraced blockchain technology, it has banned crypto trading and mining activities. On the other hand, Hong Kong regulators have been more permissive and recently proposed allowing retail investors to trade in cryptocurrencies and crypto exchange-traded funds, a move it hopes will help cement its fintech hub status.

Singapore passed its Financial Services and Markets Bill in the spring, which was a first step in regulating Singapore-registered crypto firms, and the Monetary Authority of Singapore recently released its long-awaited consultations on digital payment token services and stablecoins. Japan is also looking to bolster its crypto sector by simplifying the token listing process, publishing its NFT white paper, and passing stablecoin legislation that clarified their legal status earlier in the year. In Australia, government officials have an eye towards digital assets, beginning with a token mapping exercise as a first step towards a comprehensive crypto framework. South Korea has been experimenting with the technology and anticipates that its Digital Asset Basic Act will be in place by the first half of 2023.

Given the recent news, governments around the world are paying close attention to exchanges and several will be hosting hearings to unpack what happened with FTX and what the resulting fallout means for the industry and beyond.

Reflections on the Crypto Council’s first year

With so much going on, our team has been busy! I have been thrilled to build the team from scratch from when I joined earlier this year. In a few short months, we have brought together some of the best minds across policy, regulation, and crypto.

Over the course of 2022, the CCI team has:

- Submitted 14 comment letters on everything from tax and prudential regulation to a global regulatory blueprint.

- Released two reports: Base Layer Neutrality and The North Korean Crypto Threat

- Participated in 200 media interviews in major outlets and 70 speaking engagements across the United States, Europe, and Asia.

- Hosted 10 events, including co-hosting DC FinTech week and our State of Play Dinner series.

- Testified in front of Congress – that was a first and an honor for me!

And that’s just my top 5.

We are also honored to have quickly become a trusted voice among government partners. It has been a pleasure meeting with regulators and policymakers across the world to advance a deeper understanding of crypto and engage in constructive dialogue around much-needed regulatory frameworks. Bridging the tech-policy divide is more important than ever.

As the importance of crypto grows within the global economy, governments have recognized that inaction is not an option. Though this conversation is not new – industry has been calling for regulation since 2018 – I am heartened to see this increase in activity. Clear rules of the road will be key to protecting users and facilitating innovation for the benefit of all.

How to use the timeline

The timeline of events is not meant to be an exhaustive list of everything that happened this year in crypto. Layering key policy events, enforcement actions, and legislation on top of global news headlines will enable you to see just how many things happened at the same time this year. Selecting filters and clicking on the events will bring you to tweets, news articles and primary sources from January until early December 2022.