Summary:

- On October 11, the FSB proposed an international regulatory framework for global stablecoins and cryptoassets for public consultation by December 31, 2022.

- The dual proposal includes nine high-level recommendations on cryptoassets (CAs) and provides significantly revised and updated versions of ten recommendations on global stablecoins (GSCs), previously proposed in October 2020..

- The proposed recommendations are mostly reasonable and high-level, which could give G20 countries too much flexibility to adopt very different rules.

- This post is organized in the following sections: Background, Why do the CA and GSC Recommendations Matter? What’s in the Cryptoasset (CA) Recommendations? What do the revised GSC Recommendations say? and finally What’s next?

What Happened?

On October 11, the Financial Stability Board (FSB) published a proposed framework for the international regulation of cryptoasset activities. It contains proposed recommendations for the regulation, supervision, and oversight of cryptoasset activities (CA Recommendations) and revised proposed recommendations for the regulation, supervision, and oversight of “global stablecoins” (GSCs) (GSC Recommendations).

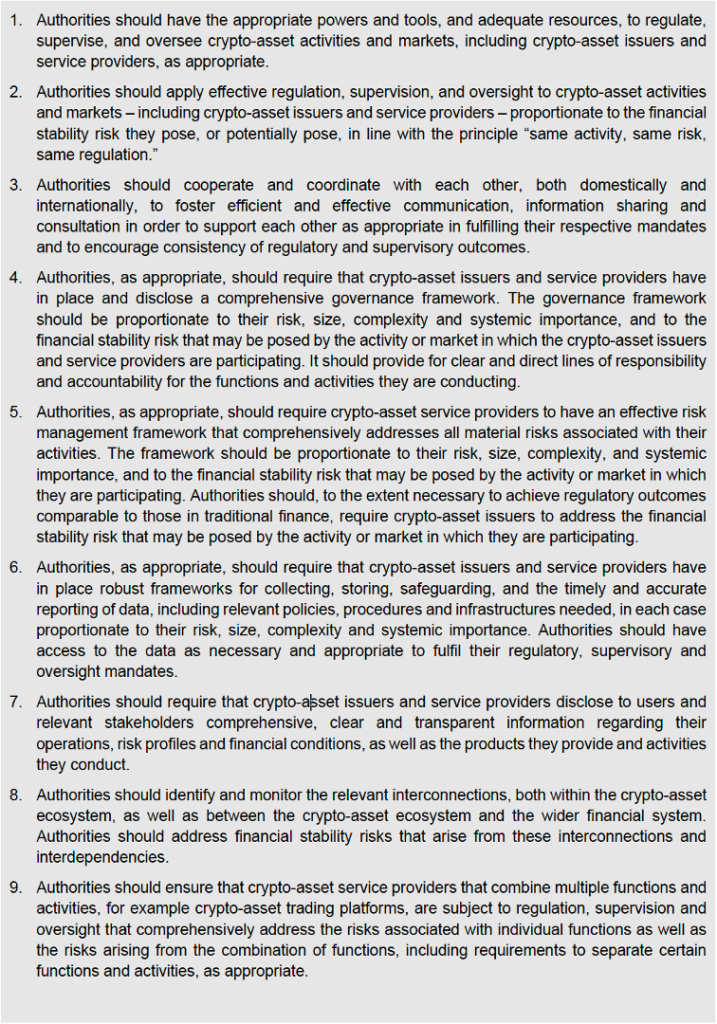

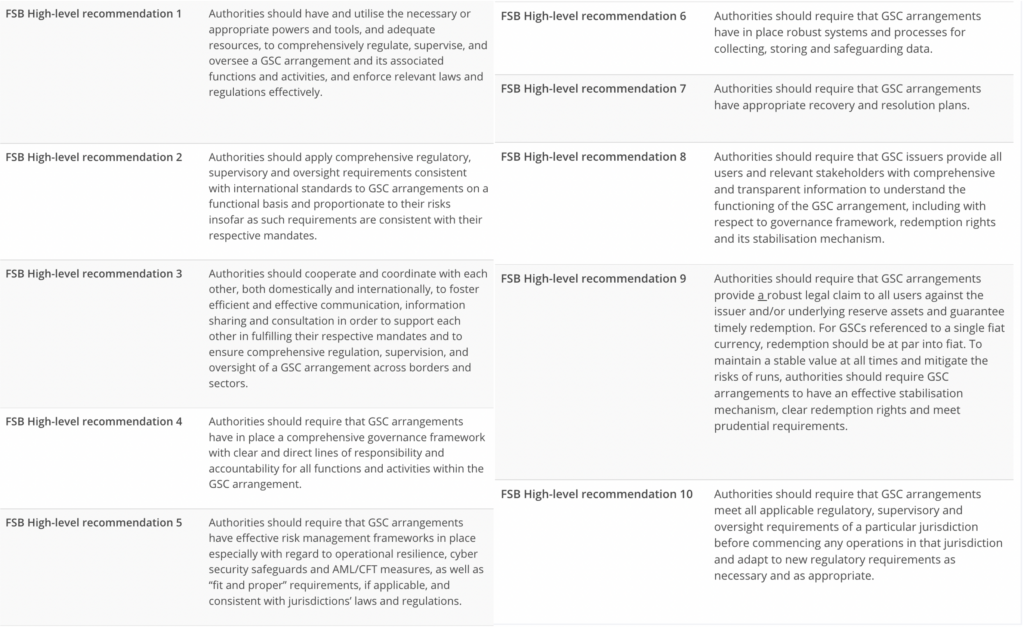

The recommendations cover a range of topics including regulatory powers, disclosures, and asset-specific requirements. The proposed CA Recommendations will apply to all cryptoassets and associated issuers and intermediaries including GSC issuers. The proposed GSC Recommendations will apply to cryptoassets that would be considered GSCs, and stablecoins with the potential to become GSCs, according to the FSB.

Background

The FSB has been paying attention to cryptoassets – especially so-called “global stablecoins” (GSCs) – for some time now. In April 2020, the FSB released a public consultative document on GSCs. In October 2020, they proposed 10 high-level recommendations on the regulation, supervision and oversight of GSCs. This was a part of their broader work on enhancing cross-border payments, commissioned by the G20. In February 2022, they published an assessment of financial stability risks and followed up with a statement on the regulation and supervision of crypto-asset activities in July of this year.

Ahead of the G20 meeting of Finance Ministers and Central Bank Governors (FMCBG), the FSB Chair Klaas Knot wrote a framing letter to the group. The Chair focused on the recent volatility in cryptoasset markets and expressed the view that they are intrinsically volatile, structurally vulnerable, and increasingly interconnected with the traditional financial system. The Chair also emphasized the need for a holistic approach and creating the conditions necessary for safe innovation.

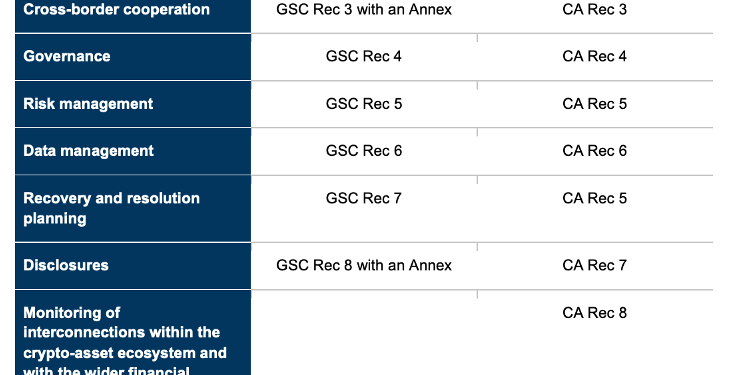

These documents are the product of consultations with the public, governments (including central banks and finance ministers), and standard-setting bodies like the Financial Action Task Force (FATF) and International Organization of Securities Commissions (IOSCO). See the table below comparing the GSC and Cryptoassets (CA) Recommendations:

Overall, it’s an important and reasonable step towards international consistency and regulatory clarity – and we support an approach that promotes “responsible innovation and providing sufficient flexibility for jurisdictions to implement domestic approaches.”

For the final recommendations, it’s important that the FSB members consider blockchain’s unique properties, which will facilitate the growth of strong and resilient digital economies where Web3 benefits of open and fair access, lower cost and efficient financial services are fully realized. Further, these recommendations are not specific, so the questions now become: what will the more detailed national rules to be developed and implemented look like, and will they bolster global consistency?

Why do the CA and GSC Recommendations Matter?

As an agenda setter in international financial regulation, the FSB’s recommendations will be highly influential in the drafting and issuance of international standard setters and, thus, national requirements for stablecoin issuers and cryptoassets.

What’s in the Cryptoasset (CA) Recommendations?

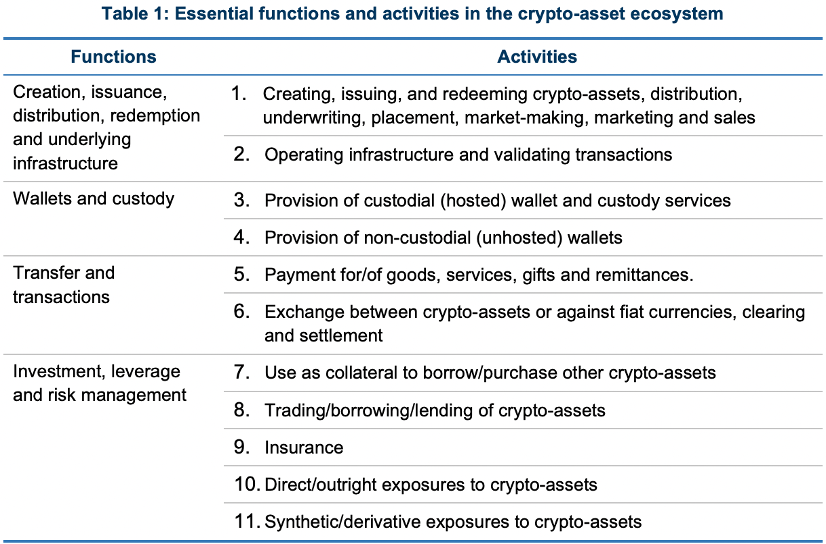

The consultative document which includes the CA Recommendations has four main parts: (1) essential activities and interconnectedness of cryptoasset markets, (2) overview of international standards and regulatory and supervisory approaches to cryptoasset activities, (3) essential issues and challenges and potential gaps, and (4) the proposed language for the CA recommendations.

The first section identifies the range of functions and activities in cryptoasset markets and goes on to explain the FSB’s views that certain intermediaries’ business models are based on an assumption of continued high growth in cryptoasset investment, that overcollateralization with cryptoassets in certain transactions is insufficient because of cryptoasset price volatility, and that interconnectedness is exacerbated by affiliation between trading platforms and other service providers. The section finishes by expressing concern about increasing links between the traditional financial sector and cryptoasset markets.

The second section provides an overview of existing regulatory approaches and the applicability of existing frameworks, especially recent work by the Basel Committee on Banking Supervision, the Bank for International Settlements’ Committee on Payments and Market Infrastructure, and the International Organization of Securities Commissions, as well as at the jurisdictional level.

The third section covers challenges in regulation, namely complications in the applicability of regulatory powers, lack of visibility into DeFi protocols, complications in cross-border regulatory cooperation, risk management related to wallets and custody, risk management in trading, lending, and borrowing, data management, and the combination of multiple functions within a single service provider.

Finally, the CA Recommendations cover regulation, supervision, and oversight of cryptoasset activities and markets and aim to establish international regulatory cooperation. The CA recommendations would apply to all cryptoassets, as well as issuers of assets, service providers, and intermediaries of all kinds. Cryptoassets that meet the FSB’s definition of GSC would be covered both by the CA Recommendations and the GSC Recommendations.

What do the revised GSC Recommendations say?

The consultative report on the FSB’s review of its GSC recommendations has three main parts: (1) recent market developments and characteristics of existing stablecoins, (2) recent policy developments, and (3) proposals to revise the GSC Recommendations.

The discussion of recent market developments focuses primarily on the collapse of the Terra/Luna algorithmic stablecoin and expresses skepticism about the use of algorithmic backing and arbitrage strategies as stabilization mechanisms. In conjunction with the Terra/Luna discussion, the review’s analysis of the characteristics of existing stablecoins finds that the largest existing stablecoins would not meet the FSB’s GSC Recommendations on governance, risk management, redemption rights, stabilization mechanisms and disclosures. The section on recent policy developments notes the progress of various jurisdictions and standard setters towards conforming their approaches to the GSC Recommendations, especially standard setters’ review of whether and how existing international standards can apply to stablecoin arrangements.

The revised GSC Recommendations attempt to address financial stability risks more effectively and emphasize the need for readiness in the application of regulations to stablecoins that become GSCs. The revisions also focus on greater clarity in governance requirements and redemption rights covering the nature of legal claims, timely redemption at par, and stabilization mechanisms.

What’s next?

The framework will be up for discussion when G20 finance ministers and central bankers meet in October. It is open for public consultation until December 31, 2022. The FSB aims to finalize the updated recommendations by July 2023 and review progress in the implementation of its final recommendations by the end of 2025.

Need more Policy Briefs? We got you.

*Please note: this version corrects the public consultation date to December 31, 2022.