Summary:

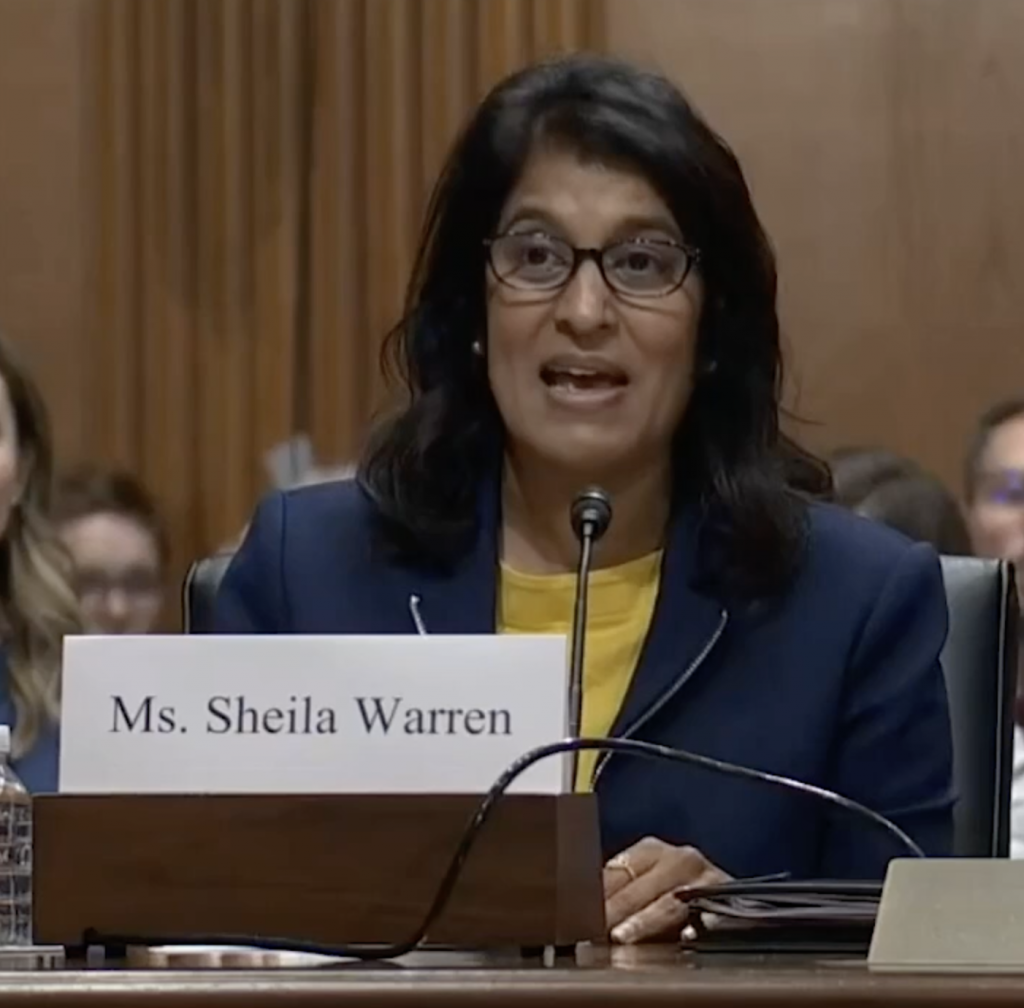

- Crypto Council CEO Sheila Warren appeared as a witness before the Senate to review the Digital Commodities Consumer Protection Act

- Warren made the case that digital assets provide many opportunities—from reducing international payment fees, to helping artists reach audiences and generate sufficient income, to building greater financial inclusion.

- The testimony—which you can read in full here—is a crash course on all things crypto and Web3, and explains why there is an urgent need for regulation and suggests ways to improve the legislation.

- Watch the session in full or check out our tweet thread for clips.

Today, Crypto Council CEO Sheila Warren appeared as a witness before the Senate Committee on Agriculture, Nutrition, and Forestry Committee hearing to review S. 4760, the Digital Commodities Consumer Protection Act, introduced August 3rd.

Testifying before Congress is an honor—and we were pleased to have the opportunity to speak directly to lawmakers, address their questions, and advocate for regulatory clarity and consumer protection.

House and Senate Committees regularly hold hearings to discuss challenges facing the country and the role of policy in helping to solve them. While only a select few hearings get any media attention, there can be as many as a dozen or more committee and subcommittee hearings happening on Capitol Hill on a given day.

These hearings are opportunities for federal officials and stakeholders (such as the Crypto Council) to provide feedback and expert insight to Congress to help inform policy—and as in the case of today’s hearing, they’re often congenial events, with lawmakers truly interested to hear experts’ opinions on legislation and how to tackle our most pressing issues.

About the Digital Commodities Consumer Protection Act

The Digital Commodities Consumer Protection Act defines digital assets as commodities, and puts them under the jurisdiction of the Commodity Futures Trading Commission (CFTC), onboarding regulations for the industry that are very much needed.

The Agriculture Committee has jurisdiction over the CFTC, which regulates the trading of commodity futures including crude oil, corn, and gold. Bitcoin futures were authorized by the CFTC in 2017.

Notably, this bipartisan legislation is sponsored by both the Chair and Ranking Member of the Senate Agriculture Committee, as well as the Senate Minority Whip—showing the strong bipartisan consensus among congressional leadership for legislation that supports the burgeoning crypto industry.

From pro-active approach to domestic and global leadership

Agriculture Chairwoman Debbie Stabenow (D-MI) and Ranking Member John Boozman (R-AR) opened the hearing by expressing support for the legislation as a way to provide market integrity and consumer protections, while also fostering crypto innovation and growth in the U.S.

CFTC Chair Rostin Behnam appeared first, noting the importance of the legislation to allow the CFTC to apply full oversight of crypto markets “without restriction,” and thereby providing greater clarity to consumers about the markets and risks. As he noted in his testimony, CFTC has “developed a deep understanding of this novel market and the underlying innovations that fuel it,” and provide the mechanism by which digital commodities “will be subject to compliance with core principles” that have underpinned America’s financial markets for decades.

The bill “is a huge step forward given the size of the market,” he said in response to a question from Sen. Joni Ernst (R-IA) about how it will encourage American innovation. It will provide “more incentives” for innovators to stay in the U.S. and start businesses here.

“What is needed so much right now is rules of the road,” said Sen. Kirsten Gillibrand (D-NY), echoing support for the bill, which she said will provide “basic clarity” on how to create crypto businesses and the oversight needed.

Crypto Council CEO Sheila Warren joined the second panel alongside representatives from Coinbase, Stellar, Citadel, and the Center for American Progress. (Coinbase is a member of the Crypto Council.)

“The Digital Commodities Consumer Protection Act is a pivotal step in achieving the clarity and oversight that are greatly needed,” Warren stated at the beginning of the testimony.

The testimony—which you can read in full here—is a crash course on all things crypto and Web3, and explains why there is an urgent need for regulation and suggests ways to improve the legislation.

As Warren outlined, digital assets have many promising use cases—from reducing international payment fees, to helping artists reach audiences and generate sufficient income, to building greater financial inclusion. MoneyGram, one of the largest cross-border transfer services, is partnering on this with Stellar.

As she explained in response to a question from Sen. Gillibrand, perhaps one of the best examples is how the crypto community galvanized to raise $100 million for Ukraine to quickly buy medical and other critical supplies.

“We would be in a very different situation in that conflict if the crypto community had not mobilized,” said Warren. “Crypto was a bridge. It was a catalyst. It was essential.”

But to fully realize the potential of these opportunities, “The United States urgently needs to take a forward-looking approach to policymaking,” said Warren. “A proactive approach to policymaking is critical for international competitiveness, national security, and consumer protection.”

The U.S. is falling behind in the world when it comes to crypto regulation. For example, regardless of your views on Central Bank Digital Currencies (CBDCs), 90% of central banks around the world are already exploring them. When looking at the G20 countries, 16 are already ahead of the U.S. China is the furthest along—and it’s “clear that China will seek to leverage its Digital Yuan as a tool to achieve its foreign policy goals.”

“There is a pressing need for regulatory clarity that promotes innovation and protects consumers,” stated Warren. “The legislation being considered today can provide some of the certainty needed to help spur international economic growth, create jobs, improve financial inclusion, and enhance privacy and security.”

“This hearing is a pivotal step in achieving the clarity and oversight that are greatly needed,” said Warren.

The Crypto Council is “grateful for the opportunity to offer our suggestions to the Committee to improve this legislation” Warren said. “We look forward to continuing to work together to advance sensible, inclusive crypto regulatory policy,” she concluded.

Both panels covered a wide array of topics, including the environmental impacts of the industry, the importance of studying DeFi, and the need for more inclusion and baseline digital literacy—watch the whole thing on the Agriculture Committee website.