This article was originally published on 2 September 2022 and updated in October 2023

Summary

- Crypto has proven invaluable as part of the Ukrainian government’s fund-raising strategy and a case study for the technology.

- Unlike fiat currencies, it is far more swiftly and easily mobilized globally- some $60 million was donated in the initial days of the conflict.

- Crypto made up part of the total funds pledged to support Ukraine, but its usefulness has been proven through this particular use case, leading the government to embed crypto more widely into the country’s financial structure.

- Read more stories of Crypto in Action.

Speed of deployment

In August, Ukraine’s Minister for Digital Transformation, Mykhailo Fedorov, tweeted a list of the main items that the authorities had bought with crypto funds. With the advent of war, the government set up a crypto fundraising site – @_AidForUkraine – which, thanks to some large-scale donations, swiftly registered almost $60 million. By July 2023, total crypto donations stood at $225 million, with donations received from supporters worldwide.

Billions of dollars have subsequently been pledged in support for Ukraine, including some $13 billion from the US alone. What is important in this crypto case study is the speed of deployment. Within days of being invaded, the government had money to spend. In this respect, Sheila Warren, CEO of the Crypto Council for Innovation, regards crypto as “a catalyst”, “a bridge” that supported the government financially before the bulk of aid arrived.

Ukraine’s Central Bank largely suspended currency trading and froze the official exchange rate. There was a run on the currency, the hryvnia, which quickly devalued. Digital money transfers were banned and wire transfers within the international SWIFT system were slowed or banned.

As a result, donations from abroad using traditional methods ran into problems. Anton Kosheliev, Co-Founder of Ukrainian charity, Palianytsia, says that because Eastern Europe has long been deemed a financially risky area, overseas banks typically scrutinize – and in some cases, reject – transfers to the country. He estimates that approximately 30% of donations to Palianytsia were blocked.

This is not the case for crypto, which instead allows individuals to donate easily and instantaneously, while safe in the knowledge that their money is arriving verifiably intact, without intervention from government or banks, and with minimal transaction costs.

Understandably, there have been concerns about the volatility of cryptocurrency, which can potentially affect the value of the donation. As Warren again explains: “This money is not sitting in wallets for very long. It’s being deployed immediately, almost instantaneously. The value it has at time of donation is really the value it is having for the purchase of humanitarian items or – crowdfunding essentially – wartime defense.”

Why crypto, why Ukraine?

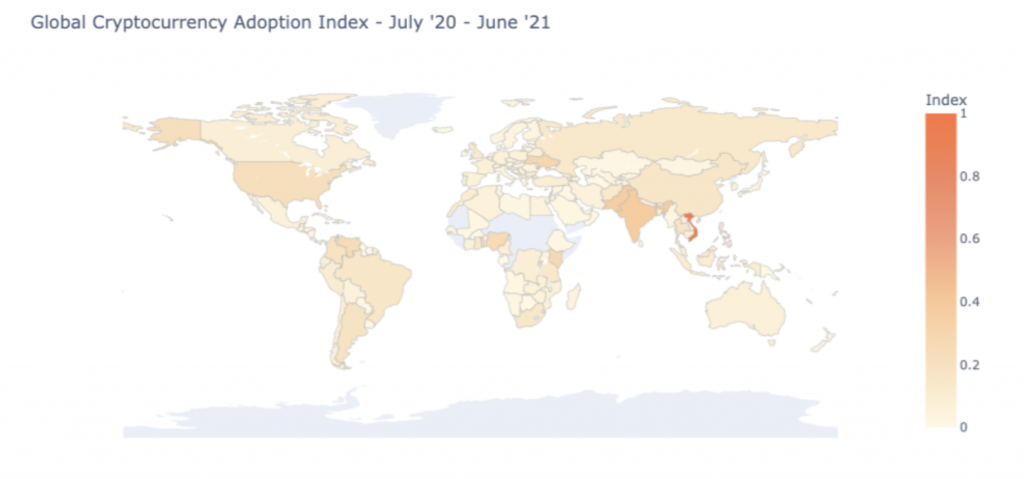

As a crypto case study, Ukraine’s use of of the technology started a few years earlier. Before the war, Ukraine was ranked as the world’s fourth-most crypto adoptive country. Reflecting this, it is little surprise that the government was swift to see crypto’s potential in meeting its short-term needs. Within 48 hours of being invaded, the government posted addresses to its crypto accounts, and now accepts 14 different cryptocurrencies. Local organizations followed suit, with calls for funds as well as NFT offerings, which have netted millions for humanitarian aid.

The government’s commitment to crypto remains. In March, President Volodymyr Zelenskyy signed several crypto regulations into law. The Virtual Assets Bill legalized the use of crypto, determining its legal status as well as introducing oversight and regulation. Work continues, with changes to tax and civil codes under way in line with the bill.

Warren explains that: “Ukraine is taking a very strong position. They are saying that this has proven to be so valuable to our citizens and our people during this critical time in our history, we want to ensure that we continue to have access to this going forward.”

The use of cryptocurrency during the war in Ukraine is proving an invaluable case study. Crypto has been used in an unprecedented way and while the outcome hasn’t been perfect – some bad actors have tried to take advantage of the situation, most obviously in setting up fake fundraising accounts – its value monetarily and practically has been shown.

Funding to the government’s and humanitarian organization’s crypto accounts continues, and increasingly crypto is being used to help support refugees. It is always difficult to provide financial services to refugees, without which they remain a highly vulnerable group. Among the solutions that crypto is offering is the use of self-hosted wallets and the creation of a crypto card, which like a regular bank card, allows users to accept financial aid through crypto transfers and pay merchants in the countries to which they have been displaced.

Crypto Case Study Outlook

War destroys stability and everyday processes that are otherwise taken for granted. Cryptocurrencies are part of the solution to the negative effects on the financial system in unprecedented emergencies and halts. They offer a funding stream far more quickly, efficiently and global than donations made and aid organized in fiat currencies. Examining crypto case studies like Ukraine will show how the technology can be utilized and how innovation can support change.