Summary:

- On October 5, an important procedural hurdle was cleared in Europe as EU ambassadors formally endorsed the final text of the Markets in Crypto Assets Regulation (MiCA).

- MiCA represents the first attempt by a leading global jurisdiction to legislate digital assets (stablecoins) and the crypto ecosystem.

- It will ensure a harmonized regime across the EU, with an impact at global level given many of those players caught by the scope are headquartered in other regions.

- Read more Crypto Council explainers

Further Details:

MiCA represents the first attempt by a leading global jurisdiction to legislate digital assets (stablecoins) and the crypto ecosystem. The Regulation is a piece of directly applicable EU law. As such, it will ensure a harmonized regime across the EU, with an impact at global level given many of those players caught by the scope are headquartered outside the EU. And given how many other jurisdictions are thinking about digital assets, MiCA could provide some useful steers on what to do (and perhaps also what not to do, in some cases….)

So who’s in/covered by the scope?

In short, it sets out EU rules covering issuers of unbacked crypto-assets, stablecoins (Asset Reference Tokens and Electronic Money Tokens), trading venues and crypto-asset service providers (CASPs) which are not considered financial instruments covered by MiFID II and crypto-wallets.

What’s out?

The Regulation does not apply to crypto-assets provided in a “fully decentralized way” without any intermediary, essentially carving out most DeFI applications, even if the term ‘fully’ is vague and not defined. Nor does it apply to the offering of crypto-assets (other than ARTs and EMTs) offered for free or automatically created as a reward for the maintenance of the DLT or the validation of transactions in the context of a consensus mechanism – so layer 1 utility tokens are also largely unaffected.

Are NFTs covered?

Not really, as long as the are unique and not fungible. However, issuance of crypto-assets as NFTs in a large series or collection should be considered as an indicator of fungibility. The Regulation therefore does applies to crypto-assets that appear unique and not fungible, but whose de facto features or uses make them either fungible or not unique.

White papers?

One of the key requirements on issuers of all MiCA crypto-assets, offerors or persons seeking admission to trading is to produce, notify the competent authority, and publish a white paper. The white paper will need to include information on the offeror and/or issuer seeking admission to trading, the operator of the trading platform and the principal adverse environmental and climate related impact of the consensus mechanism used to issue to crypto-assets.

Asset-Reference tokens (ARTs)

- Authorization and supervision: ART issuers will require authorization and will be supervised by national competent authorities. There are monitoring and reporting requirements (quarterly) for ARTs with a value issued higher than EUR 100 million.

- Cap: A last-minute modification in Council introduced a cap appliable to both euro and non-euro denominated ARTs when quarterly average number and value of transactions per day associated to uses as means of exchange is higher than 1 000 000 transactions and EUR 200 million, respectively. Investment and trading activities are not included but settlement is. This provision is likely to be detrimental to the development of digital assets in Europe but was ultimately included as it was seen as necessary in order to protect monetary independence and financial stability.

- Reserve requirements: Reserves need to be operationally segregated from the issuer’s estate, and from the reserve of assets of other tokens. Risks associated to ARTs need to be covered liquidity risks addressed.

Significant ARTs

The European Banking Authority (EBA) will supervise significant ARTs if they meet 3 of the following criteria: I) the number of holders of ARTs is larger than 10 million EUR, II) the value of ARTs or the size of the reserve is higher than 5 billion EUR, III) the number and value of transactions in the ARTs is higher than 2,500,000 transactions and 500 million EUR per day, IV) the issuer is a designated gatekeeper (as per the Digital Markets Act) or V) depending on the significance of the activities on an international scale.

Issuers of significant ARTs will be required to conduct liquidity stress testing on a regular basis and depending on the outcome of such tests EBA may decide to strengthen the liquidity risk requirements.

Electronic Monet Tokens (EMTs)

The rules for EMTs are similar to those for ARTs, with perhaps a few slightly less onerous obligations (authorization for example). EBA will also be responsible for significant EMT supervision.

EMTs denominated in a currency not official in any EU Member State must follow the rules regarding limits on transactions used as a means of exchange and settlement.

CASP supervision

CASP supervision will be the responsibility of NCAs, whereas significant CASPs will have specific reporting requirements to NCAs, who shall share these reports with ESMA, the latter having product intervention powers to temporarily prohibit or restrict activity or practice when there are clear and demonstrable irregularities committed by a CASP or an issuer.

What happens next?

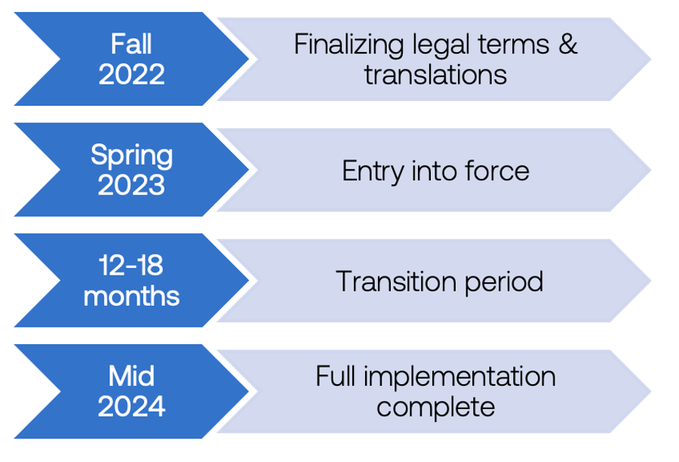

The European Parliament still needs to give its approval of the rules. This is expected to be a formality, with committee level endorsement late this month and the full house voting by the end of the year.

The legal texts are expected to be published in Q1 2023 and will enter into force 20 days after publication.

The provisions on ARTs and EMTs will apply 12 months following entry into force of the Regulation (circa spring 2024) and application of the full MiCA framework 18 months following entry into force of the text (circa fall 2024).