Summary:

- This graph of the week examines steps forward in global crypto regulation across the G20.

- The latest move by the EU will ensure a harmonized regime across 27 countries and will have a global impact given many players are headquartered in other regions.

- While the US is not yet across the line, countries like Singapore, South Korea, and the UK are showing they want to be big players in this space.

Further Details:

In this graph of the week blog, we take stock of global crypto regulation in the G20 following the EU’s big step forward. EU Ambassadors voted 28-1 in favor of final language of the Markets in Crypto Assets (MiCA) legislation. This represents the first attempt by a leading global jurisdiction to legislate digital assets (stablecoins) and the crypto ecosystem. It will ensure a harmonized regime across the EU, with an impact at global level given many of those players caught by the scope are headquartered in other regions.

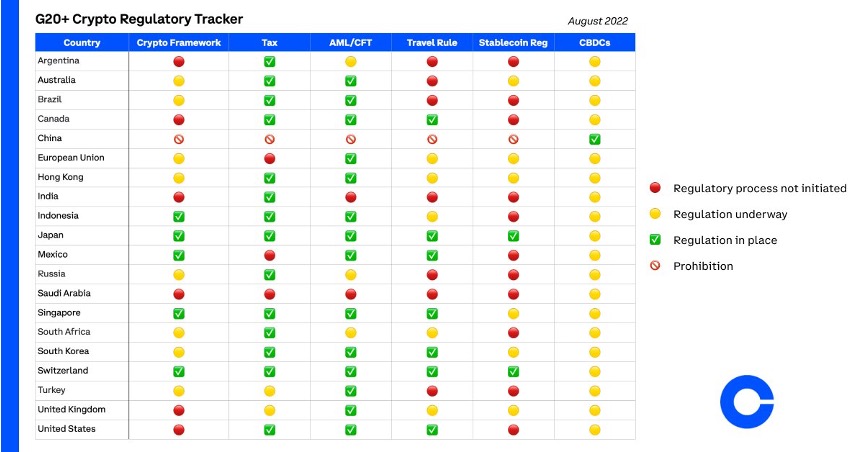

Pulling back and looking across the G20, we can see progress around the world. For those that missed it, the below chart highlights the status of crypto-related laws and regulations in G20+ countries, across six categories: crypto frameworks, tax, anti-money laundering and combating the financing of terrorism (AML/CFT), travel rules, stablecoin, and Central Bank Digital Currencies (CBDC).

As Coinbase Co-Founder and CEO Brian Armstrong tweeted, we see “significant progress on crypto regulatory clarity over the past year amongst G20,” with more “yellow” (regulation underway) and “green” (regulation in place) than in the previous year.

According to the chart, regulation is either in place or under negotiation in many G20+ countries. Notably, Japan and Switzerland have checked almost every box. A majority of G20+ countries (including the U.S.) have laws regarding tax and AML/CFT, and every country on the list is investigating CBDCs, with China furthest along.

Some top level country snap shots

With crypto regulation on the books since 2014, Canada moved further ahead in 2021, adopting a “clear registration regime for trading platforms that offer custodial services to Canadian clients,” with several firms registering, said Thomson Reuters’ latest report on global crypto regulations. Last year, Canada also published guidance to improve the quality of disclosures provided by crypto asset reporting issuers, as well as guidance on marketing and advertising.

Over the past year, Switzerland “further improved its regulations surrounding tokens,” per Thomson Reuters, while Australia began consultation on a licensing framework for cryptocurrency exchanges. Argentina, as another example on the chart, “issued regulations regarding cryptocurrencies related to taxation and AML/CFT” and “proposed legislation which would create a legal and regulatory framework for crypto-assets as a means of payments, investments and transactions,” Thomson Reuters explained.

Japanese regulators were amongst the first globally to issue regulatory guidance for crypto exchanges, especially at the back of Mt. Gox’s collapse and some high-profile crypto exchange hacks in the following years. Cryptocurrencies are regulated under the Payment Services Act and new regulations limit the issuance of stablecoins to banks and wire transfer companies only.

As a jurisdiction considered neutral to both the USA and China, Singapore leads the region when it comes to comprehensive crypto regulations. Crypto is recognized as Digital Payment Tokens (DPT) under Payment Services Act (PSA). The Monetary Authority of Singapore (MAS) issued the Financial Services and Markets Bill to bring under its purview all crypto firms registered in Singapore but were only serving oversea clients. Additionally, new 2022 guidelines prohibit marketing of DPT services to the general public.

The EU has taken a strong lead ahead of the US. For those in need of a deeper dive into MiCA and its global impact, check out our latest analysis:

But what about the US? The US does have laws regarding tax, AML/CFT, and travel. Congress introduced 35 bills related to crypto and blockchain in 2021 and 50 (so far) in 2022. The intention is there. Following the Executive Order from President Biden, a steady stream of reports have been issued from government agencies on the challenges and road ahead. To help keep track of the latest bills and reports, the Crypto Council has the below tracker:

Why we need crypto regulation

Europe has lapped the US and is miles ahead with the final language, said Sheila Warren, CEO of the Crypto Council in a recent Bloomberg Crypto interview. “In the US, we have the intention, but we are just not quite getting it across the line…In terms of other jurisdictions, you have South Korea, Australia, Singapore, the UK, all landing that they want to be big players in this space.”

The Crypto Council believes regulatory certainty – both in the US and globally – will enable more firms to invest, scale and innovate, while creating a safe and inclusive market for customers. The industry has long called for regulatory clarity, and inconsistent rules thwart growth and cause instability.