Summary:

- Many of the world’s most known exchanges were founded in Asia and the digital assets industry has grown into large ecosystems and communities.

- Crypto stakeholders in Asia are paying close attention to guidelines from the Fed, SEC and OCC, to determine suitability for US market expansion strategies.

- Highlights from key jurisdictions like Singapore, Vietnam and Australia show progress forward.

- For more insights into regional trends, check out the Council’s latest CryptoRising briefing.

Many of the world’s most known exchanges, such as Binance, FTX, BitMex and Crypto.com, were founded in Asia and the digital assets industry in the region has grown beyond speculative trading, to the emergence of large-scale ecosystems and communities. Most institutions are comfortable using blockchain, and overall, there is a proactive yet cautious movement towards regulating the industry.

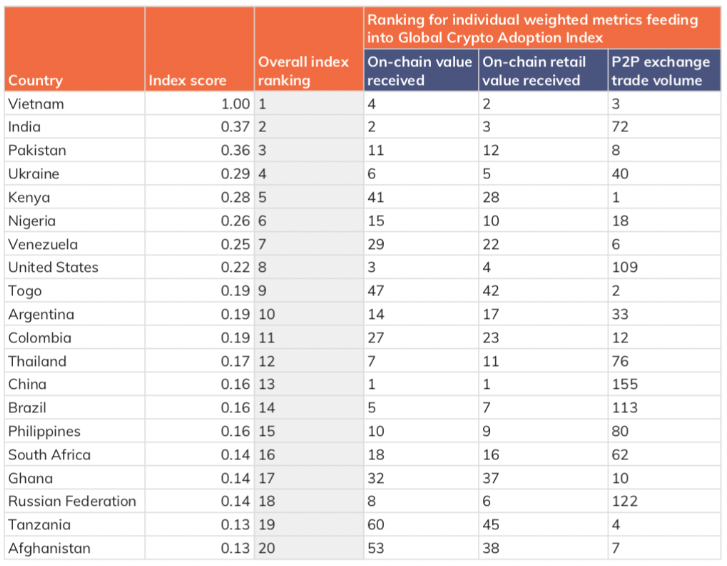

Underpinning this adoption of blockchain is the appreciation of digital finance with rapidly rising penetration of internet and mobile access across the region. With a median age of 32 years, this young and digitally savvy population has driven a high adoption of mobile payments, and over the past 12 months, alternative financial services from DeFi to Play-to-Earn platforms are also gaining momentum especially in the ASEAN countries. As per reports from Chainalysis, India, Vietnam, Singapore, Japan and Hong Kong are amongst the jurisdictions with high crypto adoption with 31% of cryptocurrency transactions occurring in East Asia.

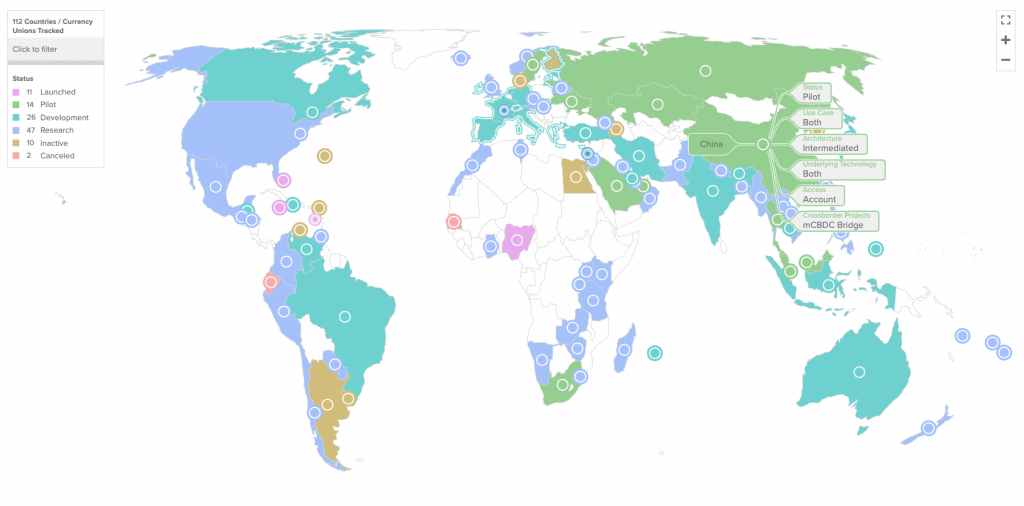

With a diverse economic and regulatory approach across 17 jurisdictions, digital asset regulations in Asia fall across a spectrum. Ranging from an open regulatory environment allowing for all crypto activities to jurisdictions where crypto is highly restricted or completely banned. Besides AML/CFT concerns, policymakers are worried about the impact of crypto on capital outflows on one hand and consumer exposure to scams/fraud on the other. As with most other jurisdictions globally, policymakers see monetary policy and financial stability risk arising from the use of private stable coins. The recent Terra incident has obviously further heightened these concerns. On the other hand, most of the central banks are exploring Central Bank Digital Currencies (CBDCs) with China running the world’s largest CBDC pilot for eCNY, having over 250 million participants over the last year.

While most policymakers’ have a decent understanding of typical structures in digital assets around centralised exchanges and crypto payments, there is still progress to be made when it comes to their depth of understanding of DeFi, including on algorithmic stablecoins. Although not as fragmented as in the USA, we often see multiple regulatory bodies operating in silos when dealing with crypto regulations between the central banks and securities regulators. We also see that crypto stakeholders in Asia are paying close attention to guidelines from the Fed, SEC and OCC, to determine suitability for US market expansion strategies. The doubling of SEC Enforcement staff is generating uneasiness among the community, with many citing the use of regulation by enforcement, as a means of clarity for digital asset market participants, not being helpful in providing best regulatory practice guidance for the rest of the world.

Highlights from key jurisdictions:

Digital Assets in East & North Asia

In Mainland China, although the government has publicly embraced blockchain technology, they have outright banned all crypto activity, including Bitcoin mining due to environmental concerns. Capital controls are a key factor in this decision, as is the highly speculative nature of crypto markets. Most of the activities now are centered around the Blockchain Services Network (BSN), as a backbone for most blockchain based applications including NFTs. While crypto is banned, large scale experimentation on retail and wholesale CBDC continues to accelerate both domestically via the eCNY, and internationally through the aCNH.

On the other hand, Hong Kong regulators have permitted most forms of crypto activity to date. In the initial ICO boom days, the Securities and Futures Commission (SFC) looked to apply existing securities rules to fundraising and listing of security tokens. Since then, having initially made VASP licenses opt-in, the regulators are moving towards all exchanges needing to be licensed while limiting crypto activity to professional investors. In 2022, the regulators have also issued consultations on the use of stablecoins and crypto-related ETFs. CBDC pilots are in full swing via Project mBridge, co-led by the Hong Kong Monetary Authority, Bank for International Settlements, Peoples Bank of China, Bank of Thailand, and Central Bank of United Arab Emirates, along with a consultation paper issued to explore the feasibility of a retail CDBC, eHKD.

The Japanese regulators were amongst the first globally to issue regulatory guidance for crypto exchanges, especially at the back of Mt. Gox’s collapse and some high-profile crypto exchange hacks in the following years. Cryptocurrencies are regulated under the Payment Services Act and new regulations limit the issuance of stablecoins to banks and wire transfer companies only. Among the banks, MUFG is the most progressive in the adoption of crypto and is in the process of issuing a stablecoin for settlement. Nomura is also launching a new digital assets company for institutional clients to gain access to DeFi, NFT and other products.

Lastly, South Korea has seen a range of crypto regulatory actions over the last few years. With high interest in crypto by retail investors, regulators have stepped in to regulate crypto trading as well as to introduce crypto tax laws. All VASPs must adhere to existing AML/KYC rules, and all trading must comply with “real-name bank accounts”. Crypto gains will be taxed at a rate of 20%, including via foreign crypto exchanges and businesse

South & South-East Asia

The Indian government has been considering introducing crypto regulations for the last 3 years but has yet to table the legislation. With very high retail participation on Indian crypto exchanges, the leading exchanges raised significant VC investments over 2021. However, despite not issuing regulations on crypto trading, the government has issued a new 30% tax on all crypto-related activities (even if they lead to a loss) and have also highly restricted crypto advertising. Coupled with the declaration by the operators of India’s most used payment interface, UPI, that it is informally restricting its payment rail for crypto trades, there has been a sharp decline in crypto activity in the country thus far in 2022.

As a jurisdiction considered neutral to both the USA and China, Singapore leads the region when it comes to comprehensive crypto regulations. Crypto is recognized as Digital Payment Tokens (DPT) under Payment Services Act (PSA). The ESG and EDB are seen as being more supportive of crypto, with a view of developing economic growth by attracting crypto firms to set up in Singapore. However, recent turnovers at the Monetary Authority of Singapore along with limited approvals under the VASP licensing scheme is frustrating to many. MAS has also issued a new bill, the Financial Services and Markets Bill, to bring under its purview all crypto firms who are registered in Singapore but were only serving overseas clients. Additionally, new 2022 guidelines prohibit marketing of DPT services to the general public.

Indonesia is the largest economy in ASEAN and has been striving to drive financial inclusion through Fintech. However, the regulators have been cautious when regulating crypto. While the country legally recognizes Bitcoin and other cryptocurrencies as commodities, Bank Indonesia has banned the use of cryptocurrencies as a payment tool. Additionally, the securities regulator, OJK has prohibited financial institutions to engage in any form of activity related to crypto asset trading. The country has seen high crypto adoption and regulators are moving in to apply investment tax and VAT to crypto trading.

In Thailand, regulators have been open-minded when it comes to crypto trading, but cryptocurrencies are not allowed to be used for payments. There is high retail participation, fuelled further by heavy crypto advertising. The government had issued a new 15% capital gains tax earlier this year on crypto but suspended following backlash from the users. Some of the large financial institutions have started engaging in the space, as seen with the SCB Bank acquiring the largest local crypto exchange Bitkup, indicating a foray into institutional offerings.

Vietnam has seen strong interest in crypto with adoption per capita topping the Chainalysis index. It has a growing blockchain developer talent and community, with many firms also servicing international companies for their blockchain requirements. Although the State Bank of Vietnam has declared that the issuance, supply, and use of Bitcoin and other cryptos are illegal as a means of payment, crypto trading has not been regulated so far. Policymakers announced in April that they are developing legal frameworks to regulate virtual assets, digital currencies and virtual currencies.

The Philippines market is unique in that the population with mobile phones is almost double that of people with bank accounts. The country also has a very high penetration of social media and Filipinos spend the most time of any nationality online. VASPs are required to register with the Bangko Sentral ng Pilipinas (BSP), and transactions are considered cross-border wire transfers. On the other hand, the country has a large NFT market presence, with many of the younger generation relying on play-to-earn platforms like Axie Infinity. These significant crypto activities have led to the ex-CFO of Binance acquiring one of the largest exchanges, Coins.ph, which was originally owned by Gojek, a ride-sharing conglomerate. Moreover, Philippines’ largest payment player, PayMaya with 40 million users, has a VASP license and has started facilitating crypto payments through its payments app.

In Australia, regulators have shown a prudent approach to the crypto industry. Currently, VASPs must register with AUTRAC for AML/CFT oversight, along with a series of regulations that are in progress with the policy makers. This includes a consultation paper issued by the Treasury to license crypto-asset secondary service providers under a new framework that may coincide with some of the existing financial services licenses. On the institutional front several firms are getting into the action, including Commonwealth Bank partnering with Gemini, ANZ Bank launching an A$DC stablecoin.

For more insights into regional trends, check out the latest CryptoRising briefing and our events page for future details.