Summary

- Cryptocurrency is decentralized digital money designed to be used over the internet that have grown as digital alternatives to money issued by governments.

- Cryptocurrencies are the first alternative to the traditional banking system, and have powerful advantages over previous payment methods and traditional classes of assets.

- Cryptocurrency provide equality of opportunity, regardless of where you were born or where you live.

- A version of this article first appeared on CoinBase. Read more Crypto Council explainers.

At its core, cryptocurrency is typically decentralized digital money designed to be used over the internet. Bitcoin, which launched in 2008, was the first cryptocurrency, and it remains by far the biggest, most influential, and best-known. In the decade since, Bitcoin and other cryptocurrencies like Ethereum have grown as digital alternatives to money issued by governments.

- The most popular cryptocurrencies, by market capitalization, are Bitcoin, Ethereum, Bitcoin Cash and Litecoin. Other well-known cryptocurrencies include Tezos, EOS, and ZCash. Some are similar to Bitcoin. Others are based on different technologies, or have new features that allow them to do more than transfer value.

- Crypto makes it possible to transfer value online without the need for a middleman like a bank or payment processor, allowing value to transfer globally, near-instantly, 24/7, for low fees.

- Cryptocurrencies are usually not issued or controlled by any government or other central authority. They’re managed by peer-to-peer networks of computers running free, open-source software. Generally, anyone who wants to participate is able to.

- If a bank or government isn’t involved, how is crypto secure? It’s secure because all transactions are vetted by a technology called a blockchain.

- A cryptocurrency blockchain is similar to a bank’s balance sheet or ledger. Each currency has its own blockchain, which is an ongoing, constantly re-verified record of every single transaction ever made using that currency.

- Unlike a bank’s ledger, a crypto blockchain is distributed across participants of the digital currency’s entire network

- No company, country, or third party is in control of it; and anyone can participate. A blockchain is a breakthrough technology only recently made possible through decades of computer science and mathematical innovations.

Most importantly, cryptocurrencies allow individuals to take complete control over their assets

Transferability

Crypto makes transactions with people on the other side of the planet as seamless as paying with cash at your local grocery store.

Privacy

When paying with cryptocurrency, you don’t need to provide unnecessary personal information to the merchant. Which means your financial information is protected from being shared with third parties like banks, payment services, advertisers, and credit-rating agencies. And because no sensitive information needs to be sent over the internet, there is very little risk of your financial information being compromised, or your identity being stolen.

Security

Almost all cryptocurrencies, including Bitcoin, Ethereum, Tezos, and Bitcoin Cash are secured using technology called a blockchain, which is constantly checked and verified by a huge amount of computing power.

Portability

Because your cryptocurrency holdings aren’t tied to a financial institution or government, they are available to you no matter where you are in the world or what happens to any of the global finance system’s major intermediaries.

Transparency

Every transaction on the Bitcoin, Ethereum, Tezos, and Bitcoin Cash networks is published publicly, without exception. This means there’s no room for manipulation of transactions, changing the money supply, or adjusting the rules mid-game.

Irreversibility

Unlike a credit card payment, cryptocurrency payments can’t be reversed. For merchants, this hugely reduces the likelihood of being defrauded. For customers, it has the potential to make commerce cheaper by eliminating one of the major arguments credit card companies make for their high processing fees.

Safety

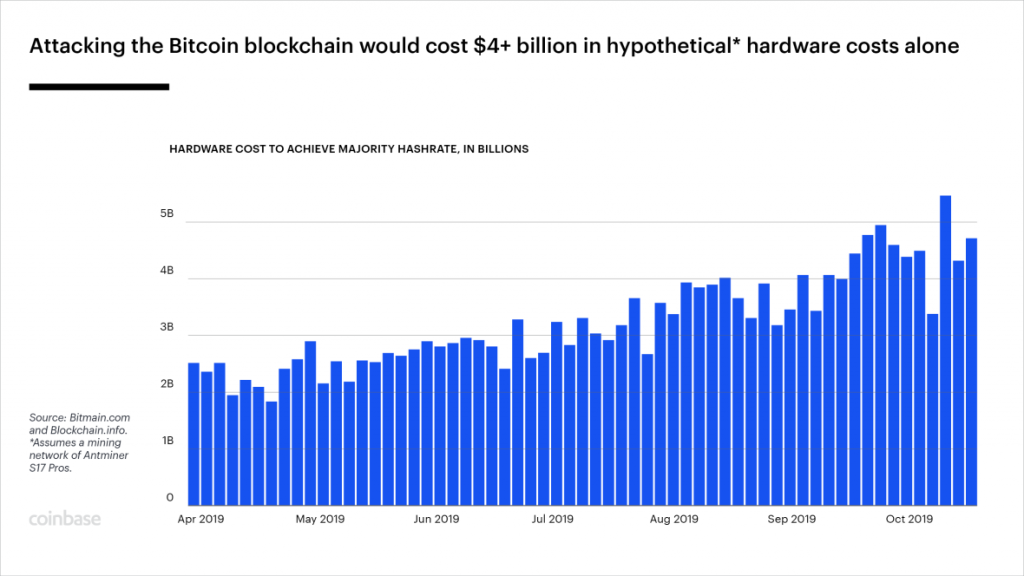

The network powering Bitcoin has never been hacked. And the fundamental ideas behind cryptocurrencies help make them safe: the systems are permissionless and the core software is open-source, meaning countless computer scientists and cryptographers have been able to examine all aspects of the networks and their security.

Why is crypto the future of finance?

Cryptocurrencies are the first alternative to the traditional banking system, and have powerful advantages over previous payment methods and traditional classes of assets. Think of them as Money 2.0. — a new kind of cash that is native to the internet, which gives it the potential to be the fastest, easiest, cheapest, safest, and most universal way to exchange value that the world has ever seen.

- Cryptocurrencies can be used to buy goods or services or held as part of an investment strategy, but they can’t be manipulated by any central authority, simply because there isn’t one. No matter what happens to a government, your cryptocurrency will remain secure.

- Digital currencies provide equality of opportunity, regardless of where you were born or where you live. As long as you have a smartphone or another internet-connected device, you have the same crypto access as everyone else.

- Cryptocurrencies create unique opportunities for expanding people’s economic freedom around the world. Digital currencies’ essential borderlessness facilitates free trade, even in countries with tight government controls over citizens’ finances. In places where inflation is a key problem, cryptocurrencies can provide an alternative to dysfunctional fiat currencies for savings and payments.

- As part of a broader investment strategy, crypto can be approached in a wide variety of ways. One approach is to buy and hold something like bitcoin, which has gone from virtually worthless in 2008 to thousands of dollars a coin today. Another would be a more active strategy, buying and selling cryptocurrencies that experience volatility.

- One option for crypto-curious investors looking to minimize risk is USD Coin, which is pegged 1:1 to the value of the U.S. dollar. It offers the benefits of crypto, including the ability to transfer money internationally quickly and cheaply, with the stability of a traditional currency. Coinbase customers that hold USDC earn rewards, making it an appealing alternative to a traditional savings account.

Digital currencies provide equality of opportunity, regardless of where you were born or where you live.

How does cryptocurrency work?

Bitcoin is the first and most well-known, but there are thousands of types of cryptocurrencies. Many, like Litecoin and Bitcoin Cash, share Bitcoin’s core characteristics but explore new ways to process transactions. Others offer a wider range of features. Ethereum, for example, can be used to run applications and create contracts. All four, however, are based on an idea called the blockchain, which is key to understanding how cryptocurrency works.

- At its most basic, a blockchain is a list of transactions that anyone can view and verify. The Bitcoin blockchain, for example, is a record of every time someone sends or receives bitcoin. This list of transactions is fundamental for most cryptocurrencies because it enables secure payments to be made between people who don’t know each other without having to go through a third-party verifier like a bank.

- Blockchain technology is also exciting because it has many uses beyond cryptocurrency. Blockchains are being used to explore medical research, improve the sharing of healthcare records, streamline supply chains, increase privacy on the internet, and so much more.

- The principles behind both bitcoin and the Bitcoin blockchain first appeared online in a white-paper published in late 2007 by a person or group going by the name Satoshi Nakamoto.

- The blockchain ledger is split across all the computers on the network, which are constantly verifying that the blockchain is accurate.This means there is no central vault, entity, or database that can be hacked, stolen, or manipulated.

Cryptocurrencies use a technology called public-private key cryptography to transfer coin ownership on a secure and distributed ledger. A private key is an ultra secure password that never needs to be shared with anyone, with which you can send value on the network. An associated public key can be freely and safely shared with others to receive value on the network. From the public key, it is impossible for anyone to guess your private key.

What is mining?

Most cryptocurrencies are ‘mined’ via a decentralized (also known as peer-to-peer) network of computers. But mining doesn’t just generate more bitcoin or Ethereum – it’s also the mechanism that updates and secures the network by constantly verifying the public blockchain ledger and adding new transactions.

- Technically, anyone with a computer and an internet connection can become a miner. But before you get excited, it’s worth noting that mining is not always profitable. Depending on which cryptocurrency you’re mining, how fast your computer is, and the cost of electricity in your area, you may end up spending more on mining than you earn back in cryptocurrency.

- As a result, most crypto mining these days is done by companies that specialize in it, or by large groups of individuals who all contribute their computing power.

- How does the network encourage miners to participate in maintaining the blockchain? Again, taking Bitcoin as an example, the network holds a lottery in which all the mining rigs around the world race to become the first to solve a math problem, which also verifies and updates the blockchain with new transactions. Each winner is awarded new bitcoin, which can then make its way into the broader marketplace.

Need more Explainers?

Check out the Crypto Council’s resources for all your explainer needs. More content added regularly.