Summary

- Bitcoin is digital money that allows for secure and seamless peer-to-peer transactions on the internet.

- It creates the potential for an open financial system that is more efficient, more free, and more innovative.

- Bitcoin is the world’s first completely open payment network which anyone with an internet connection can participate in.

- This article first appeared on CoinBase. Read more Crypto Council explainers.

Bitcoin was created by Satoshi Nakamoto, a pseudonymous person or team who outlined the technology in a 2008 white paper. It’s an appealingly simple concept: BTC is digital money that allows for secure peer-to-peer transactions on the internet.

- Unlike services like Venmo and PayPal, which rely on the traditional financial system for permission to transfer money and on existing debit/credit accounts, bitcoin is decentralized: any two people, anywhere in the world, can send BTC to each other without the involvement of a bank, government, or other institution.

- Every transaction involving BTC is tracked on the blockchain, which is similar to a bank’s ledger, or log of customers’ funds going in and out of the bank. In simple terms, it’s a record of every transaction ever made using BTC.

- Unlike a bank’s ledger, the Bitcoin blockchain is distributed across the entire network. No company, country, or third party is in control of it; and anyone can become part of that network.

- There will only ever be 21 million BTC. This is digital money that cannot be inflated or manipulated in any way.

- It isn’t necessary to buy an entire BTC: you can buy just a fraction of one if that’s all you want or need.

Key Questions

What is BTC?

BTC is the abbreviation for bitcoin.

Is Bitcoin cryptocurrency?

Yes, bitcoin is the first widely adopted cryptocurrency, which is just another way of saying digital money.

Is there a simple bitcoin definition?

Bitcoin is digital money that allows secure and seamless peer-to-peer transactions on the internet.

What’s the price of bitcoin?

The current price of BTC can be found on Coinbase’s website.

Is Bitcoin an investment opportunity?

Like any other asset, you can make money by buying BTC low and selling high, or lose money in the inverse scenario.

At what price did Bitcoin start?

One BTC was valued at a fraction of a U.S. penny in early 2010. During the first quarter of 2011, it exceeded a dollar. In late 2017, its value skyrocketed, topping out at close to $20,000. You can track the price of BTC here.

BTC is digital money that allows for secure and seamless peer-to-peer transactions on the internet

Bitcoin Basics

Since Bitcoin’s creation, thousands of new cryptocurrencies have been launched, but bitcoin (abbreviated as BTC) remains the largest by market capitalization and trading volume. The question remains what is bitcoin?

- Bitcoin is a currency native to the Internet. Unlike government-issued currencies such as the dollar or euro, Bitcoin allows online transfers without a middleman such as a bank or payment processor. The removal of those gatekeepers creates a whole range of new possibilities, including the potential for money to move around the global internet more quickly and cheaply, and allowing individuals to have maximum control over their own assets.

- Bitcoin is legal to use, hold, and trade, and can be spent on everything from travel to charitable donations. It’s accepted as payment by businesses including Microsoft and Expedia.

- Is bitcoin money? It’s been used as a medium of exchange, a store of value, and a unit of account—which are all properties of money. Meanwhile, it only exists digitally; there is no physical version of it.

Who created Bitcoin?

To really grasp how bitcoin works, it helps to start at the beginning. The question of who created bitcoin is a fascinating one, because a decade after inventing the technology—and despite a lot of digging by journalists and members of the crypto community—its creator remains anonymous.

- The principles behind Bitcoin first appeared in a white paper published online in late 2008 by a person or group going by the name Satoshi Nakamoto.

- This paper wasn’t the first idea for digital money drawing on the fields of cryptography and computer science—in fact, the paper referred to earlier concepts—but it was a uniquely elegant solution to the problem of establishing trust between different online entities, where people may be hidden (like bitcoin’s own creator) by pseudonyms, or physically located on the other side of the planet.

- Nakamoto devised a pair of intertwined concepts: the BTC private key and the blockchain ledger. When you hold bitcoin, you control it through a private key—a string of randomized numbers and letters that unlocks a virtual vault containing your purchase. Each private key is tracked on the virtual ledger called the blockchain.

When Bitcoin first appeared, it marked a major advance in computer science, because it solved a fundamental problem of commerce on the internet: how do you transfer value between two people without a trusted intermediary (like a bank) in the middle? By solving that problem, the invention of bitcoin has wide-ranging ramifications: As a currency designed for the internet, it allows for financial transactions that range across borders and around the globe without the involvement of banks, credit-card companies, lenders, or even governments. When any two people—wherever they might live—can send payments to each other without encountering those gatekeepers, it creates the potential for an open financial system that is more efficient, more free, and more innovative. That, in a nutshell, is bitcoin explained.

BTC creates the potential for an open financial system that is more efficient, more free, and more innovative.

How Bitcoin works

Unlike credit card networks like Visa and payment processors like Paypal, bitcoin is not owned by an individual or company. Bitcoin is the world’s first completely open payment network which anyone with an internet connection can participate in. Bitcoin was designed to be used on the internet, and doesn’t depend on banks or private companies to process transactions.

One of the most important elements of BTF is the blockchain, which tracks who owns what, similar to how a bank tracks assets. What sets the Bitcoin blockchain apart from a bank’s ledger is that it is decentralized, meaning anyone can view it and no single entity controls it.

Here are some details about how it all works:

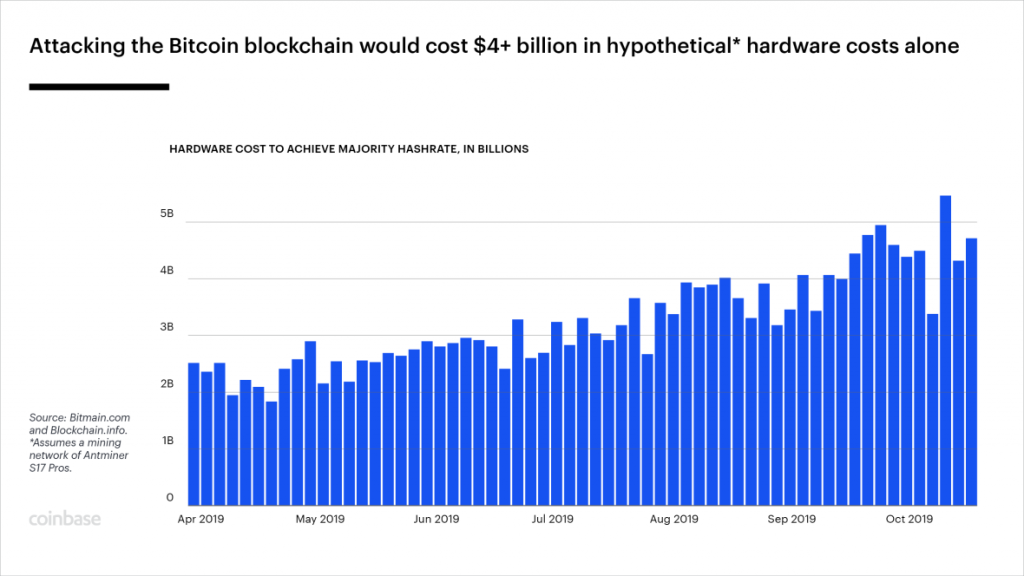

- Specialized computers known as ‘mining rigs’ perform the equations required to verify and record a new transaction. In the early days, a typical desktop PC was powerful enough to participate, which allowed pretty much anyone who was curious to try their hand at mining. These days the computers required are massive, specialized, and often owned by businesses or large numbers of individuals pooling their resources. (In October 2019, it required 12 trillion times more computing power to mine one BTC than it did when Nakamoto mined the first blocks in January 2009.)

- The miners’ collective computing power is used to ensure the accuracy of the ever-growing ledger. Bitcoin is inextricably tied to the blockchain; each new BTC is recorded on it, as is each subsequent transaction with all existing coins.

- How does the network motivate miners to participate in the constant, essential work of maintaining the blockchain—verifying transactions? The Bitcoin network holds a continuous lottery in which all the mining rigs around the world race to be the first to solve a math problem. Every 10 min or so, a winner is found, and the winner updates the Bitcoin ledger with new valid transactions. The prize changes over time, but as of early 2020, each winner of this raffle was awarded 12.5 bitcoin.

- At the beginning, a BTF was technically worthless. As of the end of 2019, it was trading at around $7,500. As bitcoin’s value has risen, its easy divisibility (the ability to buy a small fraction of one bitcoin) has become a key attribute. One BTC is currently divisible to eight decimal places (100 millionths of one BTC); the bitcoin community refers to the smallest unit as a ‘Satoshi.’

- Nakamoto set the network up so that the number of BTC will never exceed 21 million, ensuring scarcity. There are currently around 3 million bitcoin still available to be mined, which will happen more and more slowly. The last blocks will theoretically be mined in 2140.

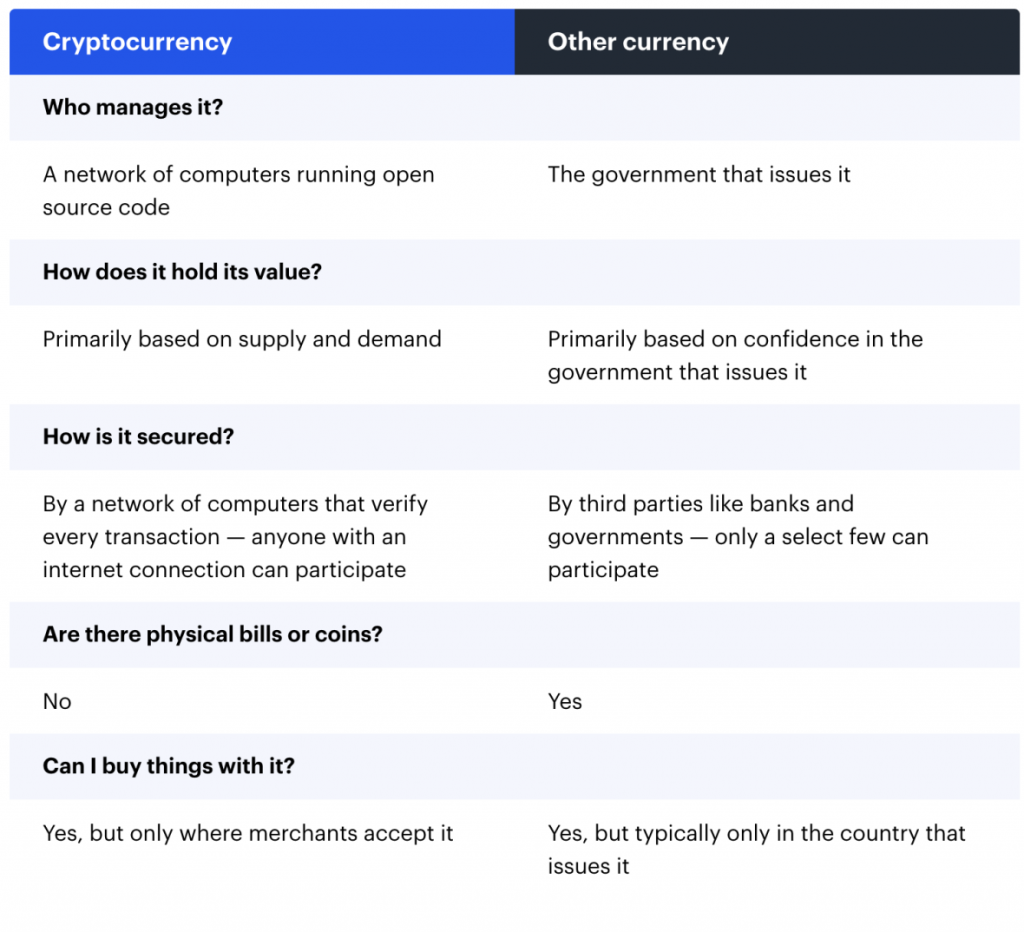

Cryptocurrencies and traditional currencies share some traits — like how you can use them to buy things or how you can transfer them electronically — but they’re also different in interesting ways. Here are a few highlights.

Bitcoin is the world’s first completely open payment network which anyone with an internet connection can participate in.

How does BTC have value?

Essentially the same way a traditional currency does – because it’s proven itself to be a viable and convenient way to store value, which means it can easily be traded for goods, services, or other assets. It’s scarce, secure, portable (compared to, say, gold), and easily divisible, allowing transactions of all sizes.

What’s the difference between Bitcoin and Blockchain?

All BTC transactions and public keys are recorded on a virtual ledger called the blockchain. The ledger is effectively a chronological list of transactions. This ledger is copied—exactly—across every computer that is connected to the BTC network, and it is constantly checked and secured using a vast amount of computing power across the globe. The blockchain concept has turned out to be powerful and adaptable, and there are now a wide variety of non-cryptocurrency-related blockchains that are used for things like supply-chain management. The ‘BTC Blockchain’ specifically refers to the virtual ledger that records bitcoin transactions and private keys.

What makes Bitcoin a new kind of money?

Global

You can send it across the planet as easily as you can pay with cash in the physical world. It isn’t closed on weekends, doesn’t charge you a fee to access your money, and doesn’t impose any arbitrary limits.

Irreversible

BTC is like cash, in the sense that transactions cannot be reversed by the sender. In comparison, credit cards, conventional online payment systems, and banking transactions can be reversed after the payment has been made—sometimes months after the initial transaction—due to the centralized intermediaries that complete the transactions. This creates higher fraud risk for merchants, which can lead to higher fees for using credit cards.

Private

When paying with bitcoin, there are no bank statements, or any need to provide unnecessary personal information to the merchant. The transactions don’t contain any identifying information other than the bitcoin addresses and amounts involved.

Secure

Due to the cryptographic nature of the Bitcoin network, bitcoin payments are fundamentally more secure than standard debit/credit card transactions. When making a bitcoin payment, no sensitive information is required to be sent over the internet. There is a very low risk of your financial information being compromised, or having your identity stolen.

Open

Every transaction on the Bitcoin network is published publicly, without exception. This means there’s no room for manipulation of transactions (save for a highly unlikely 51% attack scenario) or changing the supply of bitcoin. The software that constitutes the core of Bitcoin is free and open-source so anyone can review the code.

Safe

In more than ten years of existence, the bitcoin network has never been successfully hacked. And because the system is permissionless and open-sourced, countless computer scientists and cryptographers have been able to examine all aspects of the network and its security.

Where does Bitcoin come from?

Bitcoin is virtually ‘mined’ by a vast, decentralized (also referred to as ‘peer-to-peer’) network of computers that are constantly verifying and securing the accuracy of the blockchain. Every single BTC transaction is reflected on that ledger, with new information periodically gathered together in a “block,” which is added to all the blocks that came before.

Need more Explainers?

Check out the Crypto Council’s resources for all your explainer needs. More content added regularly.