Summary

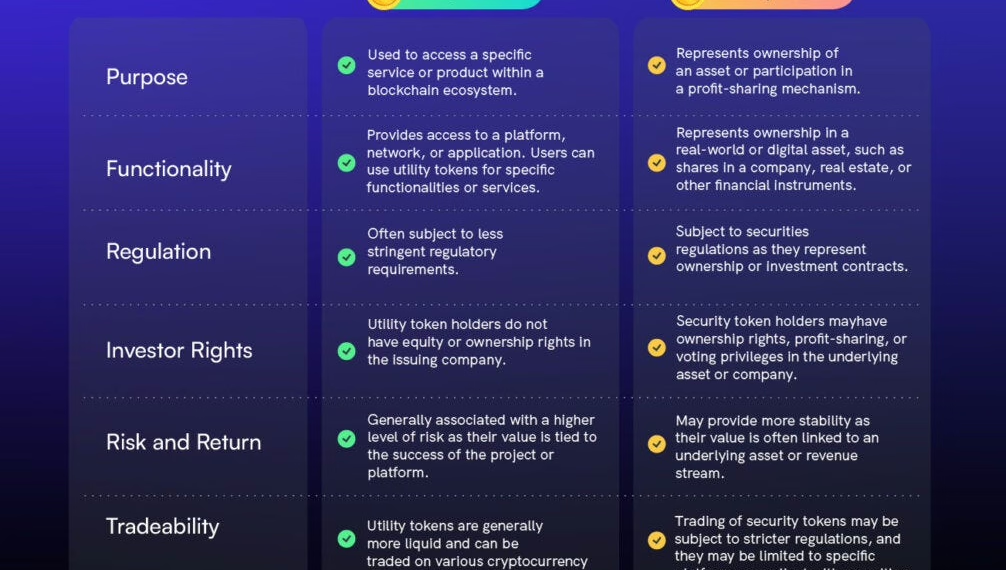

- Utility tokens provide access to a product or service within a specific blockchain ecosystem, while security tokens represent ownership in an asset.

- Security tokens are subject to federal securities regulations, while utility tokens are largely unregulated.

- The value of security tokens is directly related to the valuation of the company or asset issuing the token, while utility tokens do not denote any ownership of the project.

- A version of this article first appeared on Coinbase. Read more Crypto Council Explainers.

What are Utility Tokens?

Utility tokens, also referred to as ‘user tokens’, serve a specific function within a decentralized application or ecosystem. They are built on blockchain platforms such as Ethereum or others that support smart contracts. The unique feature of these tokens is their utility, which goes beyond being a store of value or a medium of exchange.

Utility tokens grant holders access to specific functionalities, services, or features within a dApp or blockchain network.

They are often issued during Initial Coin Offerings (ICOs) or Initial Dex Offerings (IDOs). Holders of utility tokens also have certain privileges such as access to specific services or discounted fees.

For instance, Basic Attention Token (BAT) is used by advertisers as a means of payment for different services on the Brave browser. Users may receive BAT rewards for viewing advertisements and these can be utilized within the ecosystem.

What are Security Tokens?

Security tokens represent ownership or a stake in real-world assets, similar to traditional securities such as stocks or bonds. These tokens provide holders with ownership rights in the underlying asset, which can include equity in a company or claims on a revenue stream.

The value of security tokens is directly linked to the performance and valuation of the underlying asset. Companies issuing security tokens must comply with federal securities regulations, such as the Howey Test in the U.S., which ensures that these tokens meet specific legal and financial standards.

Key Differences

The key differences between utility tokens and security tokens lie in their usage, valuation, and regulation.

Utility tokens provide access to services or features within a blockchain ecosystem but do not grant ownership or profit-sharing rights. They are generally unregulated, leading to potential volatility and less legal protection.

In contrast, security tokens represent ownership or shares in an asset, offering profit-sharing or dividends and are subject to federal regulations, which provide a level of protection and transparency.

Source: Medium

Tradeoffs

Security tokens may provide holders with a potential compensation tied to the asset they represent, similar to traditional stocks or bonds. They are subject to federal securities regulations, which can provide added security and transparency. However, they also carry additional risks, such as regulatory changes and market fluctuations.

On the other hand, utility tokens provide access to a product or service and are not considered securities. As a result, they are not subject to the same regulations as security tokens and can be more volatile in price. However, they may provide holders access to new products or services.

Both utility and security tokens have their unique features and potential benefits. The choice between acquiring utility tokens or security tokens depends on an individual’s goals, risk tolerance, and understanding of the cryptocurrency market. It is crucial to conduct thorough research and due diligence before acquiring any type of token.