Summary Points:

- On-chain transactions are conducted directly on the blockchain, and are well-suited for high-value transactions due to their trustless framework.

- Off-chain transactions occur outside the main blockchain network, often through secondary layers. They offer fast processing speeds and lower fees.

- Both transaction types are crucial in the crypto ecosystem, with on-chain offering security and off-chain providing efficiency, allowing for tailored use based on needs.

- Read more Crypto Council Explainers.

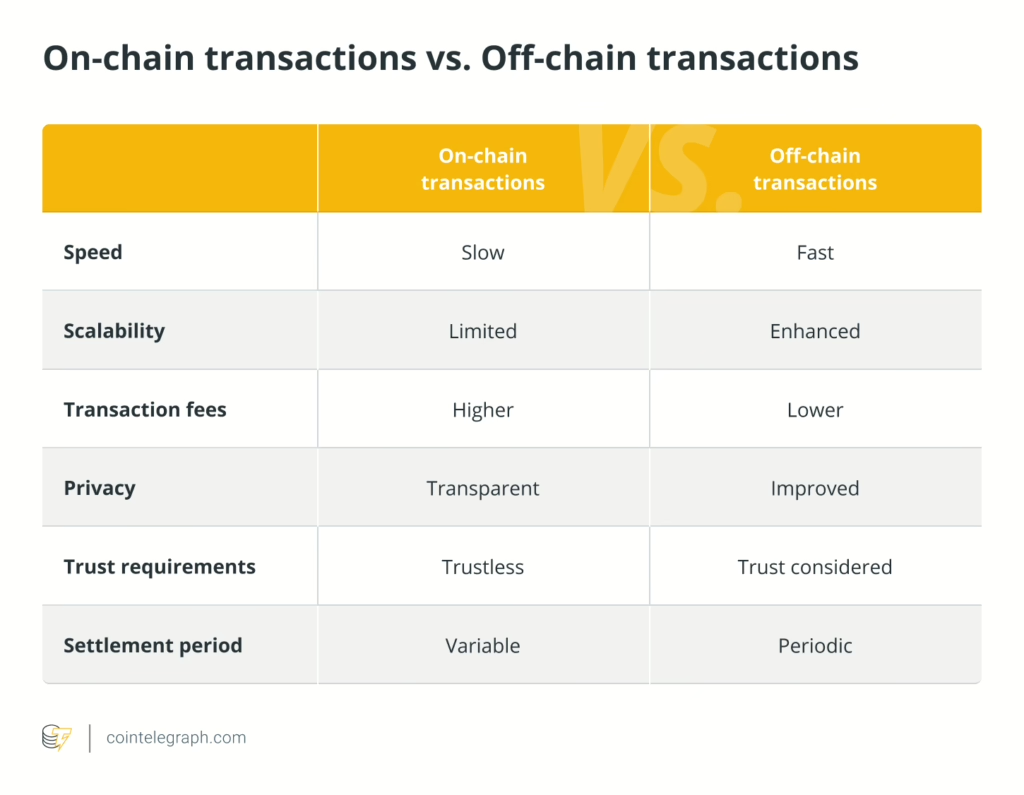

Understanding the fundamental differences between on-chain and off-chain transactions is vital for navigating the digital frontier. These two transaction modalities represent diverse approaches to managing the inherent challenges of blockchain technology, such as security, speed, cost efficiency, and scalability. On-chain transactions are the backbone of blockchain’s transparent and secure framework, while off-chain transactions provide a more flexible alternative for specific use cases. By exploring their respective benefits and drawbacks, these transaction types can be strategically utilized to optimize the efficiency, cost-effectiveness, and overall functionality of digital currency operations.

What are On-Chain Transactions?

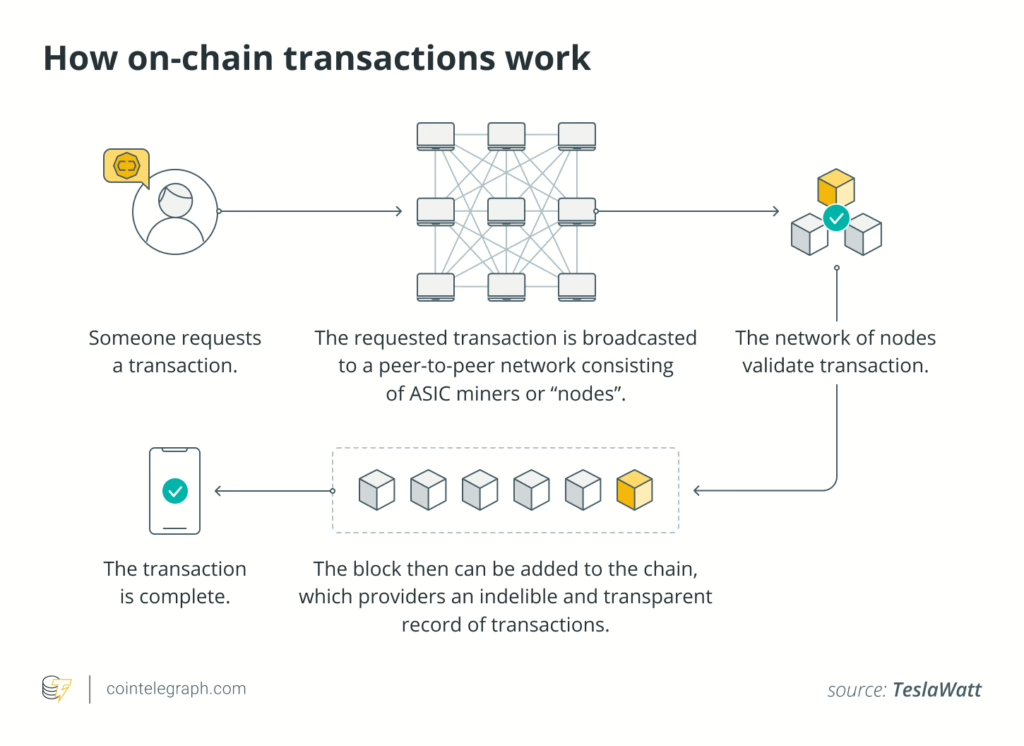

On-chain transactions, otherwise known as public ledger transactions, means a transaction is conducted directly on the blockchain, where they are permanently recorded and validated. This process involves broadcasting transaction details across the network, which are then verified through consensus mechanisms like Proof of Work (PoW) or Proof of Stake (PoS). The decentralized nature of the blockchain ensures that these transactions are secure and transparent, as they are immutable and publicly accessible.

The primary benefit of on-chain transactions lies in their trustless framework, eliminating the need for intermediaries. This system ensures that all transaction data is permanently recorded on the blockchain, making it valuable for high-value transactions (like asset transfers and real estate deals) where security and certainty are crucial. The blockchain’s inherent security features help mitigate fraud risks, providing a reliable framework for critical financial dealings.

Despite their strengths, on-chain transactions come with certain limitations. One of the primary drawbacks is their slower processing speed, particularly during times of high network activity. The process of adding transactions to the blockchain involves complex cryptographic calculations, leading to potential delays in confirmation, especially during peak times. Another challenge is scalability. As the volume of transactions increases, the blockchain can become congested, leading to longer processing times and higher transaction fees.

Source: Cointelegraph

What are Off-Chain Transactions?

Off-chain transactions means the transaction occurred outside the main blockchain network, often through secondary layers or independent networks. Technologies like payment channels, sidechains, and state channels enable these transactions, allowing users to transfer value more quickly and with lower fees. For instance, the Lightning Network for Bitcoin facilitates off-chain transactions by creating private payment channels, where only the final transaction outcome is recorded on the blockchain. Off-chain transactions offer significant advantages in terms of speed and cost efficiency, making them practical for everyday microtransactions. Additionally, they provide enhanced privacy, as transaction details are not immediately published on the main blockchain.

However, this system can introduce complexities, including potential security vulnerabilities, as it often requires reliance on additional trust mechanisms or third-party services. Off-chain transactions require users to place trust in network operators or off-chain solution providers, which can lead to concerns about reliability and trustworthiness.The necessity for periodic settlement on the main blockchain can introduce delays and potential security vulnerabilities. Additionally, off-chain solutions tend to lack the same level of transparency as on-chain transactions, which can reduce accountability by discouraging it.

Off-chain transactions may not be suitable for all scenarios, particularly those involving the transfer of highly valuable assets. In such cases, the full security and decentralization offered by the main blockchain are crucial, making off-chain options less viable.

What are the Tradeoffs?

Both on-chain and off-chain transactions serve vital roles within the crypto ecosystem, tailored to different scenarios and user needs. On-chain transactions are indispensable for situations requiring robust security and irrevocability, where transparency is crucial. They are well-suited for high-stakes transactions where the risk of fraud needs to be minimized. On the other hand, off-chain transactions excel in scenarios demanding speed and lower costs. They are particularly useful for smaller-scale, frequent transactions, such as daily purchases, where the high fees and slower processing times of on-chain transactions would be impractical.

Source: Cointelegraph

As the crypto landscape continues to evolve, both on-chain and off-chain transactions will play pivotal roles in shaping the future of digital finance. Understanding their unique characteristics and appropriate use cases allows for more informed decision-making, whether for personal transactions or larger-scale financial operations. By leveraging the strengths of both transaction types, the crypto ecosystem can achieve a balance of security, efficiency, and scalability. This explainer highlights the importance of both transaction types in addressing the diverse needs of users, from ensuring the security of high-value transfers to facilitating the speed and efficiency required for everyday transactions.