Summary

- About 70% of the 165 bills on the US State level are still under active consideration or have already passed, demonstrating the traction these legislative efforts are gaining.

- In CCI’s latest monthly update, we are starting with New Hampshire – the state is working to establish a legal framework for DAOs with House Bill 645. Connecticut and Maine are broadening their Money Transmission statutes to include certain virtual currency business activity.

- Oklahoma enacted HB 3594 to protect bitcoin mining and custody, New York has updated customer service standards for virtual currency businesses, while Wyoming explores AI governance and data ownership best practices.

- Read our state digital asset policy news roundup and share on X and LinkedIn.

The Rising Legislative Focus on Digital Assets

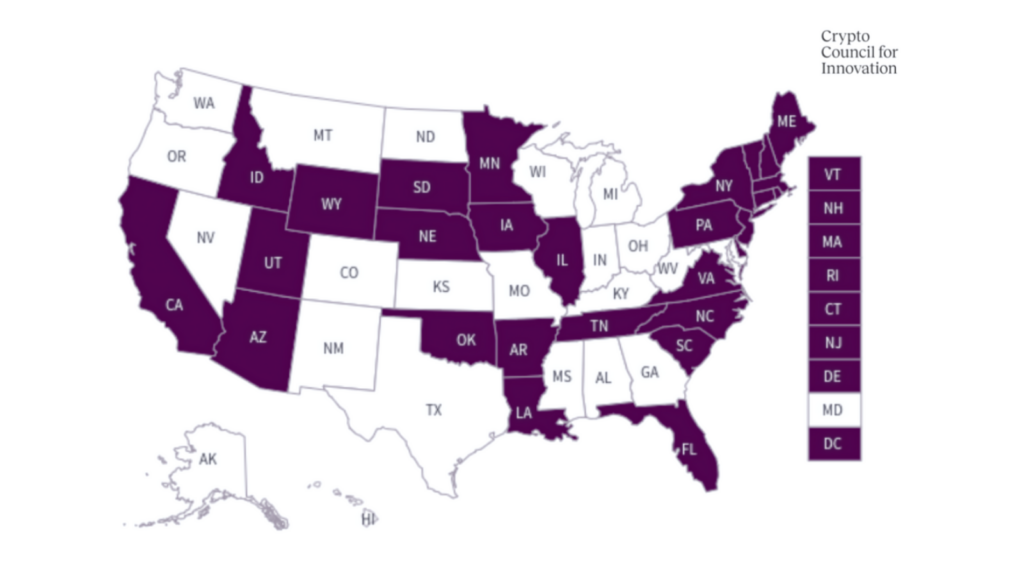

A robust interest in integrating digital assets into financial systems is growing, with over 165 bills concerning digital assets introduced in various state legislative sessions across the country this year. Remarkably, about 70% of these bills are still under active consideration or have already passed, demonstrating the traction these legislative efforts are gaining.

This high level of activity suggests that the interest in digital assets extends beyond a trend, highlighting a broader, enduring shift towards recognizing their economic and innovative potential. Proactive and fit-for-purpose regulations are pivotal for the future of finance and technology in the US, in helping foster innovation and creating a structured approach to incorporating digital assets into the economy.

US States are providing a blueprint for future policies, potentially guiding other jurisdictions at home and abroad.

As summer approaches and many state legislatures prepare to adjourn, digital asset legislation continues to hold a place of prominence on legislative agendas across the country. States like New Hampshire and Wyoming are at the forefront, crafting innovative laws to both regulate and promote the burgeoning digital assets industry.

New Hampshire Leads with DAO Legislation

On May 23, New Hampshire’s House Bill 645 received Senate approval, marking a major milestone in the state’s legislative approach to blockchain technology. This pioneering legislation would establish a legal framework for DAOs, positioning New Hampshire alongside Wyoming and Louisiana as a leader in embracing novel regulation for advanced blockchain structures.

The bill, which now awaits Governor Chris Sununu’s signature, showcases New Hampshire’s stance in supporting innovative and decentralized business models. If it passes, New Hampshire will be taking an important step is fostering a favorable environment for blockchain technology and encouraging technological innovators and entrepreneurs to consider the state as a potential hub. Read more about the NH bill.

Maine & Connecticut Look to Update MTLs for Virtual Currency

Maine and Connecticut took steps towards updating their Money Transmission Licensing (MTL) statutes. In Maine, Governor Janet Mills officially sanctioned LD 2112, effectively expanding the state’s definition of money transmission to include virtual currency business activities. This adaptation aims to bring certain digital asset activities within the regulatory purview of MTLs. However, while these legal frameworks may provide appropriate oversight for specific facets of digital assets, they potentially fail to address the broader and more complex aspects of the burgeoning Web3 ecosystem. This highlights a need for regulatory approaches that accommodate the unique challenges and characteristics of the digital asset space. Details of LD2112.

In Connecticut, House Bill 5211, which has passed both state houses, includes virtual currency kiosks under the definition of money transmission. The Connecticut Department of Banking had not previously recognized virtual currency kiosks as falling under this category.

By incorporating virtual currency kiosks into the MTL statute, the state acknowledges the growing role of digital currencies in everyday financial transactions.. The legislation is still pending approval from Governor Ned Lamont. Details of HB 5211.

Wyoming Holds Hearing on 2024 Interim Topics – Sheila Warren Testifies

Meanwhile, Wyoming is strengthening its reputation as a pioneering state in digital asset regulation. The state’s proactive stance was highlighted during a recent hearing by the state legislature’s Select Committee on Blockchain, Financial Technology, and Digital Innovation Technology. The discussions at this hearing delved into AI governance and the complexities of data ownership.

CCI CEO Sheila Warren provided testimony on Wyoming’s influential role in shaping the digital asset landscape. Her insights underline the state’s commitment to creating a favorable regulatory environment that supports innovation and addresses emerging issues in the digital realm, including the intersection of crypto and AI governance. Watch Sheila Warren’s testimony.

Oklahoma Safeguards Bitcoin Rights

Oklahoma’s HB 3594 marks significant progress in the state’s legislative approach to crypto, specifically focusing on bitcoin mining and custody. The new regulations, signed into law by Governor Kevin Stitt are set to take effect on November 1, 2024. They are designed to provide a more stable and encouraging environment for those involved in various aspects of digital asset management and operations. Read about Oklahoma’s legislative approach.

New York Updates Customer Service Guidance

The New York Department of Financial Services (NYDFS) has recently issued new guidelines revising customer service standards for virtual currency businesses. These guidelines mandate specific practices for complaint resolution and ongoing monitoring.

The move by the NYDFS is intended to standardize the level of service customers can expect when interacting with virtual currency services, seeking to make the processes more transparent and responsive to consumer needs. NYDFS Customer Service Requirements.

Check out our April state digital asset policy blog here.