Summary

- France is one of Europe’s most crypto-friendly countries.

- It has had crypto legislation in place since 2019, and is a noted hub for DeFi.

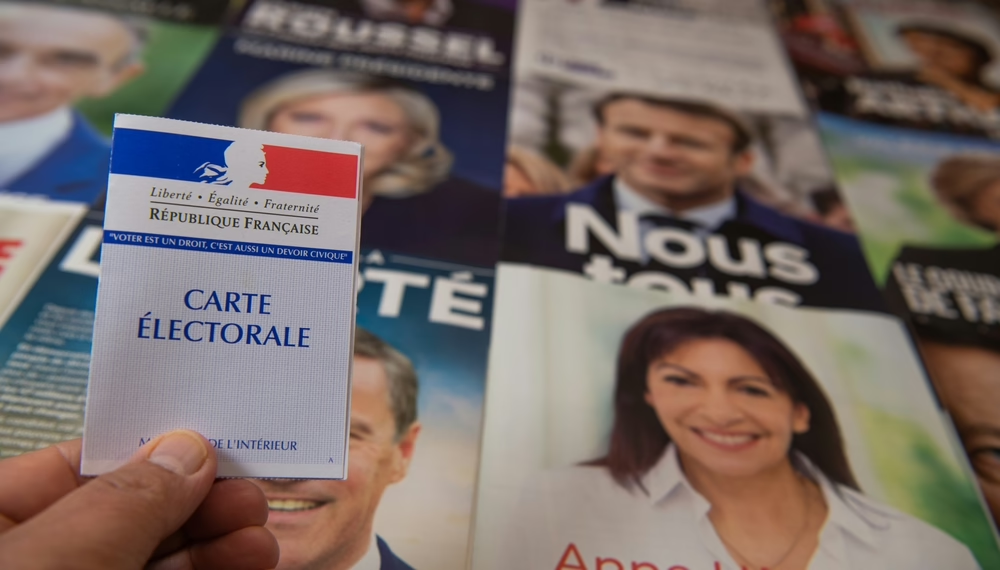

- July’s legislative elections have created some tension about the outlook for crypto.

- It is feared that the leftist alliance, which emerged with the most seats following the elections, will – if it gets into power – greatly increase taxation on crypto assets, striking a blow to the sector and its French users.

- Read other Crypto in Action articles.

Politics remains uneasy following snap elections

Paris’ vibrant opening ceremony to the Olympic Games boosted spirits in a country reeling from June and July’s political events. The respite is, however, likely to be temporary, with political uncertainty expected to linger after the Games have ended.

July’s snap elections, which followed the poor showing of President Emmanuel Macron’s party and its centrist allies in the European Parliamentary elections, saw the left-wing alliance, the New Popular Front (NPF), take the most seats in the National Assembly. It failed, however, to secure a majority, setting France on course for a hung parliament and months of political wrangling.

Political wrangling rarely bodes well for stability and policy progress, particularly when, as is the case, the three major political ‘groupings’ (the other being the far-right National Rally) are diametrically opposed. Without either a new prime minister or government, analysts expect months of political instability as France finds itself in uncharted waters. Never has it had an election outcome where three blocs secured a similar amount of the votes. Without major compromise, none of the political groupings will manage to secure the 289 seats required to form a government.

The industry should, therefore, expect policy stasis until the political impasse is broken. If, as is possible, the NPF ultimately leads a government, tax hikes are possible. During campaigning the NPF promised to abolish Macron’s tax cuts, which had helped attract a number of crypto firms and seen tech giants like Google choose to headquarter their European operations in France.

Currently, occasional gains from the sale of crypto assets are subject to a tax rate of 30% and professional cryptocurrency activities are taxed up to 45%. The NFP has suggested rates ranging from 0% to 90%. It has also said that it would restore an exit tax, which prevents individuals from avoiding tax when moving to another country. Reintroduction of a wealth tax is also being considered and would have widespread popular support.

How crypto is used in France

Cryptocurrency is legal in France. Bitcoin and other cryptocurrencies are categorized as digital assets and taxed in the same way as stocks.

In Chainalysis’s 2023 global adoption index, France was ranked 23rd for crypto adoption, and in Europe, was fourth in terms of raw cryptocurrency value received. As of 2024, one in eight of the population hold crypto assets, marking a 28% rise in adoption year-on-year, with most investors under the age of 35.

Bitcoin remains the favoured cryptocurrency. Those buying cryptocurrencies can either use the likes of Bitcoin ATMs to make a cash deposit or peer-to-peer (P2P) networks.

Cryptocurrencies are not legal tender, but businesses can choose to use them as payment for services, in line with regulations.

Cryptocurrency mining is legal and not subject to specific regulation, but in practice, few companies undertake it in France.

In terms of transaction volume, France is a major player in DeFi, with French authorities actively thinking about an appropriate future regulatory regime.

The government’s attitude to crypto

Under President Macron, France has become a welcoming hub for the crypto and blockchain sectors. The President vowed to make his country a “start-up nation” seeking to make it Europe’s crypto asset hub.

France has also become one of the most regulated countries in the world in terms of crypto. French regulators were among the world’s first to create a framework for digital asset providers. This in turn, provided a template for the EU’s Markets in Crypto-Assets Regulation (MiCA), which will govern how cryptocurrency businesses operate throughout the bloc.

The pivotal piece of legislation – the PACTE Act – was passed in 2019 and essentially established a framework for initial coin offerings (ICOs) and intermediaries dealing with cryptocurrencies, Digital Asset Service Providers (DASP), typically referred to as an exchange or broker.

Those seeking to pursue a blockchain or crypto project in France, must first apply for a visa from the financial market authority, the Autorité des Marchés Financiers (AMF), incorporate themselves as a legal entity in France, provide information about the project, create a system for monitoring or guarding assets, and comply with anti-money laundering (AML) and anti-terrorist financing regulations.

Since PACTE’s introduction, the AMF’s supervisory and enforcement powers have been strengthened. Further guidelines were published in 2022 clearly defining the AML/CFT requirements for DASPs, extending to custodians, exchanges, issuers and service providers. Regulations were again tightened in 2023 and early 2024, including enhancing traceability of crypto asset transfers and identity verification. All this has created a transparent and safe framework for those operating in the crypto and blockchain sectors.

France’s crypto influence in Europe

As one of the founding members of the EU and as one of its largest member states, France has significant influence in the EP. Reflecting its domestic interest in crypto and blockchain, its Members of the European Parliament (MEPs) have been instrumental in shaping the bloc’s crypto policy. This is evidenced in their presence on key committees, including the Economic and Monetary Affairs (ECON) committee as well as collective work on MiCA and AML regulation.

Timeline of crypto legislation

In 2013, France’s central bank, the Banque de France, published a report highlighting the risks that virtual currencies posed.

A year later, the government made an initial attempt to regulate the nascent sector. The Prudential Supervision and Resolution Authority (ACPR) required entities receiving legal currency on behalf of clients related to cryptocurrency purchase or sale needed to obtain a license so that they could provide payment services.

In 2016, the authorities included cryptocurrency trading platforms and brokers on a list of entities subject to AML legislation.

The following year, a regulatory framework was introduced for ICOs.

The PACTE Act was passed in 2019, creating a framework for digital assets and exchanges.

The same year, a specific provision was introduced into the tax code. It related to gains derived by French residents from the occasional crypto trading.

MiCA was passed in the European Parliament in 2022, entered into force in June 2023, with application and implementation continuing during 2024.

As of 1 January 2023, the tax regime distinguished between individual and professional sellers, with the former taxed at a flat rate of 30%.

Also in 2023, Société Générale obtained the country’s first crypto license, allowing it to offer its institutional clients further opportunities in custody, trading and sales.

Outlook – uneasiness until political impasse is broken

France has under President Macron created a broadly welcoming, clearly regulated environment for the blockchain and crypto sector. It has worked hard to position itself as a top crypto hub in Europe, but faces competition from the likes of the Netherlands and the UK. Its continued – and future – success depend on policy stability and continuing refinements to regulation, which support rather than deter activity in the sector.

Political instability will inevitably have an adverse effect, introducing a note of wariness into investment decisions and the sector’s outlook. This is likely to be magnified if the NPF secure sufficient seats to lead a majority, something that could point to increased public spending and deficit, requiring changes to the country’s tax rates. The European Commission opened an excessive deficit procedure against France prior to the elections. Whoever leads the next French government will have a tightrope to walk in terms of delivering on some of their electoral promises without exacerbating dire public financing constraints.