In the first installment of the Crypto Council’s Graph of the Week – a study by the US Federal Reserve found Americans without access to bank accounts and credit cards are turning to crypto.

Conducted every year since 2013 on the economic well-being of US households, the report outlines the financial opportunities and challenges facing US families. Surprisingly, 1 in 5 Americans said they are “just” getting by or find it “difficult” to get by financially. Even more surprising, 6% percent of adults (nearly 20 million Americans) do not have a bank account. This increases as the numbers break down further: Black (13%) and Hispanic (11%) adults are more likely not to have a bank account.

The study includes data on access to financial systems and included a section on crypto use. According to the report, “In 2021, most people using cryptocurrencies did so for investment purposes. In 2021, 12 percent of adults held or used cryptocurrencies in the prior year…Those who held cryptocurrency purely for investment purposes were disproportionately high-income, almost always had a traditional banking relationship, and typically had other retirement savings. Forty-six percent of those using cryptocurrencies only for investment had an income of $100,000 or more.”

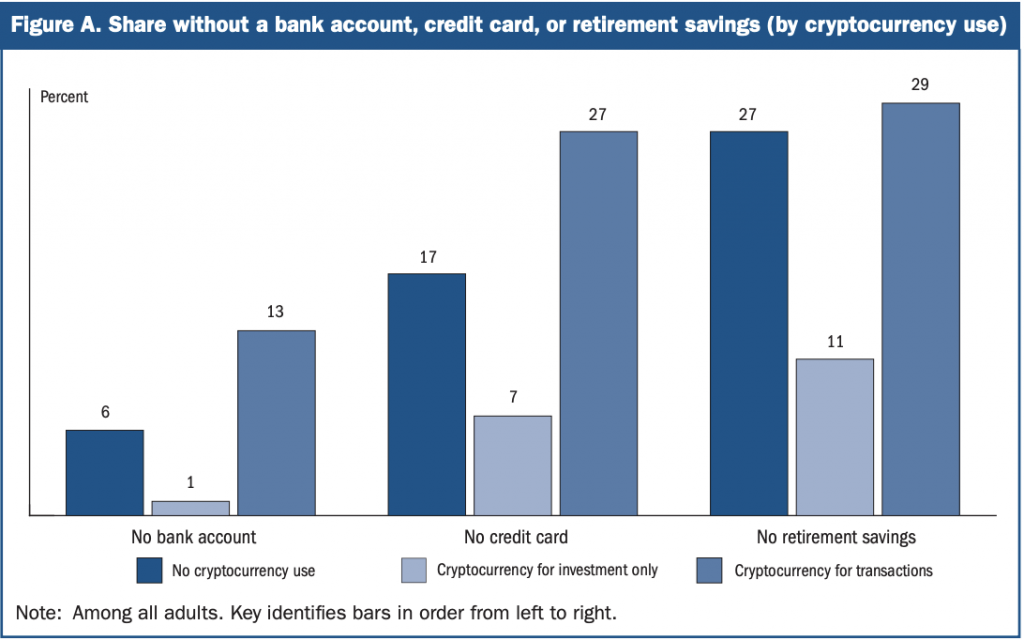

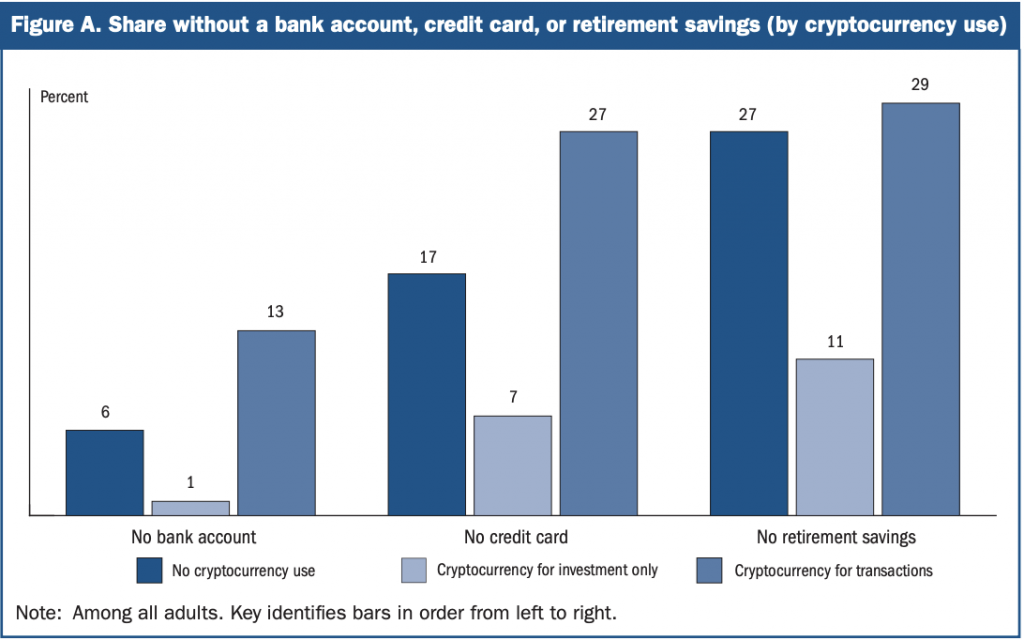

The graph below stood out. Americans without access to traditional financial tools like bank accounts, credit cards and retirement savings turned to crypto to carry out financial transactions. Nearly 30% of those with neither retirement savings nor credit cards used crypto for transactions.

Although the study does state that the overall the financial well-being rose in the US, more can be done to ensure equal access for all.

The role of local banks

Local banks did this job in the past – but they are closing fast. Some 9% of branches closed between 2017 and 2021 (that’s 7,500 locations). This rate doubled during the pandemic. Low to moderate income & minority communities represent 30% of all closures.

Declining trust

Experts say local bank closures can lead to breakdown in trust. Bank branches were thought of as the principal conduit for access to financial services and building trust & financial literacy.

They also boost local communities. Researches found one bank branch can generate millions in lending opportunities: $3 million in metro areas, $2 million in smaller cities and nearly $2 million in rural areas. As local bank branches close, the share of underbanked and unbanked populations can rise.

The importance of having options like crypto cannot be overstated. Between the rise in banking deserts and reports of a growing decline in trust in governments and financial institutions, people are looking for options.

We see crypto users building communities and filling the trust gap. But, we are at a critical moment to help leaders understand this industry. It is important to build awareness with policymakers, regulators, and the public about the depth and breadth of work in progress.

The Council highlighted crypto’s role in financial inclusion in many of the Comment letters submitted to US government leaders. Read the letters to the Department of Financial Protection and Innovation and Department of Treasury.