- Stablecoins offer a way to bridge the gap between fiat currencies like the U.S. dollar and cryptocurrencies.

- Because they are price-stable digital assets that behave somewhat like fiat but maintain the mobility and utility of cryptocurrency, stablecoins are a novel solution to crypto volatility: price stability is built directly into the assets themselves.

- There are four primary stablecoin types, identifiable by their underlying collateral structure: fiat-backed, crypto-backed, commodity-backed, and algorithmic.

- This article first appeared on Gemini’s Cryptopedia. Check out the Crypto Council’s Resources for all your explainer needs. More content on the way. Get in touch if there is a topic we can help with.

How Do Stablecoins Work?

As with any emerging asset class, cryptocurrencies are susceptible to market forces. Accordingly, many crypto projects are actively exploring ways to reduce risk and bolster participation in the broader crypto ecosystem. Current solutions go well beyond the buy, sell, and stop orders of conventional markets. Instead, price stability is being built directly into the assets themselves. The result is an entirely new subset of the cryptocurrency market known as stablecoins. These tokens are meant to function the way their name suggests — with stability.

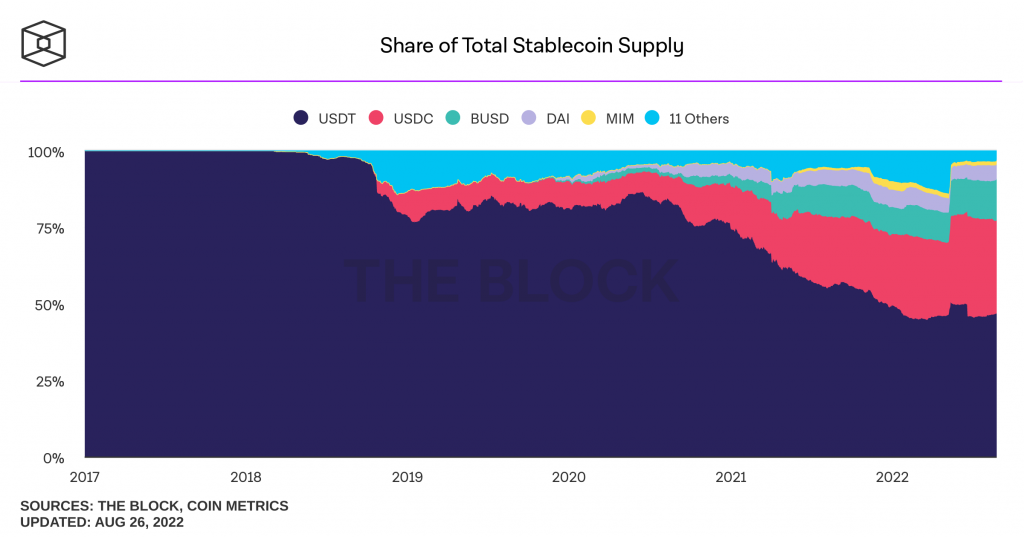

In 2020–21, the stablecoin market exploded, its market cap expanding by almost three times. But, what precisely is driving this appeal? Let’s start by reviewing the basics of stablecoin taxonomy.

Stablecoin Taxonomy

Stablecoins are digital currencies minted on the blockchain that are typically identifiable by one of four underlying collateral structures: fiat-backed, crypto-backed, commodity-backed, or algorithmic. While underlying collateral structures can vary, stablecoins always aim for the same goal: stability. Let’s dive into the four primary types of stablecoins.

Traditional Collateral (Off-Chain)

The most popular stablecoins are backed 1:1 by fiat currency. Because the underlying collateral isn’t another cryptocurrency, this type of stablecoin is considered an off-chain asset. Fiat collateral remains in reserve with a central issuer or financial institution, and must remain proportionate to the number of stablecoin tokens in circulation.

For example: If an issuer has $10 million of fiat currency, it can only distribute 10 million stablecoins, each worth one dollar. Some of the biggest stablecoins in this category by market value include Tether (USDT), the Gemini Dollar (GUSD), True USD (TUSD), and Paxos Standard (PAX).

Crypto Collateral (On-Chain)

As the name implies, crypto-collateralized stablecoins are backed by another cryptocurrency as collateral. This process occurs on-chain and employs smart contracts instead of relying on a central issuer. When purchasing this kind of stablecoin, you lock your cryptocurrency into a smart contract to obtain tokens of equal representative value. You can then put your stablecoin back into the same smart contract to withdraw your original collateral amount. DAI is the most prominent stablecoin in this category that makes use of this mechanism. This is realized by utilizing a collateralized debt position (CDP) via MakerDAO to secure assets as collateral on the blockchain.

Crypto-collateralized stablecoins are also over-collateralized to buffer against price fluctuations in the required cryptocurrency collateral asset. For example, if you want to buy $1,000 worth of DAI stablecoins, you would need to deposit $2,000 worth of ETH — this equates to a 200% collateralized ratio. If the market price of ETH drops but remains above a set threshold, the excess collateral buffers DAI’s price to maintain stability. However, if the ETH price drops below a set threshold, collateral is paid back into the smart contract to liquidate the CDP.

Algorithmic Stablecoins

Algorithmic stablecoins do not use fiat or cryptocurrency as collateral. Instead, their price stability results from the use of specialized algorithms and smart contracts that manage the supply of tokens in circulation. An algorithmic stablecoin system will reduce the number of tokens in circulation when the market price falls below the price of the fiat currency it tracks. Alternatively, if the price of the token exceeds the price of the fiat currency it tracks, new tokens enter into circulation to adjust the stablecoin value downward.

Commodity-Backed Stablecoins

Commodity-backed stablecoins are collateralized using physical assets like precious metals, oil, and real estate. The most popular commodity to be collateralized is gold; Tether Gold (XAUT) and Paxos Gold (PAXG) are two of the most liquid gold-backed stablecoins. However, it is important to remember that these commodities can, and are more likely to, fluctuate in price and therefore have the potential to lose value.

Commodity-backed stablecoins facilitate investments in assets that may otherwise be out of reach locally. For instance, in many regions, obtaining a gold bar and finding a secure storage location is complex and expensive. As a result, holding physical commodities like gold and silver isn’t always a realistic proposition. However, commodity-backed stablecoins also afford utility to those that want to exchange tokens for cash or take possession of the underlying tokenized asset. Holders of Paxos Gold (PAXG) stablecoins can sell them for cash or take possession of the underlying gold. However, because London Good Delivery gold bars range from 370-to-430 per ounce, and each token represents 1 ounce, users must hold a minimum of 430 PAXG to execute token redemption. Once redeemed, token holders can take possession of their gold at vaults throughout the UK.

Similarly, holders of Tether Gold can redeem XAUT tokens in exchange for physical gold if they complete the TG Commodities Limited verification process and hold a minimum of 430 XAUT. This minimum reflects the standard 430 oz London Bullion Market Association (LBMA) gold bar. Once XAUT is redeemed, holders can take possession of their gold at a location of their choosing within Switzerland. Although the ability to redeem gold-backed stablecoins for physical gold is universal across active platforms, other commodity-backed stablecoins lack the same utility. For example, Venezuela’s exploratory Petro stablecoin isn’t redeemable for a barrel of oil. While stablecoins backed by other commodities like real estate have made headlines in recent years, a lack of active projects makes it difficult to draw further comparison.

In contrast, the tokenization of assets continues to generate interest in a closely related market segment. Similar to commodity-backed stablecoins, tokenized assets derive their value from external, tradable assets like gold.

Medium of Exchange and Store of Value

The most immediately apparent advantage of stablecoin technology is its utility as a medium of exchange, effectively bridging the gap between fiat and cryptocurrency. By minimizing price volatility, stablecoins can achieve a utility wholly separate from the ownership of legacy cryptocurrencies.

As their name suggests, stablecoins are inherently stable assets, making them a suitable store of value, which encourages their use in everyday transactions. Further, stablecoins improve the mobility of crypto assets throughout the ecosystem.

Stablecoins point the way toward integrating traditional financial markets with the quickly evolving decentralized finance (DeFi) industry. As a force for market stability, stablecoins present a primary vehicle for cryptocurrency adoption in loan and credit markets, while inheriting much of the utility previously reserved for only fiat currency.

Disclaimer: Cryptopedia does not guarantee the reliability of the Site content and shall not be held liable for any errors, omissions, or inaccuracies. The opinions and views expressed in any Cryptopedia article are solely those of the author(s) and do not reflect the opinions of Gemini or its management. The information provided is for informational purposes only, and it does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. A qualified professional should be consulted prior to making financial decisions. Please visit Cryptopedia Site Policy to learn more.

Need more Explainers?

Check out the Crypto Council’s Resources for all your explainer needs. More content added regularly. Get in touch if there is a topic we can help with.