(updated 8 September)

Summary:

- Over 50 digital asset bills have been introduced in Congress.

- This summer saw bipartisan leadership from Senators Lummis and Gillibrand, Toomey and Sinema, Stabenow and Boozman, and an amendment to the Infrastructure bill.

- September is what’s next for crypto policy – it is a busy month for policymakers and the industry with multiple reports and hearings.

- The Crypto Council will testify on the Digital Commodities and Consumer Protection Act on 14 September.

- Stay up to date with insights from the Crypto Council.

With the end of August recess in sight, let’s take a look at the very busy autumn and what’s coming up for crypto and the US Congress.

As the US looks to retain its leadership role as a global innovator, important steps were made this summer on the Hill. The Crypto Council commends the bipartisan leadership in this nuanced and complicated space.

On 7 June, Senators Lummis and Gillibrand introduced their comprehensive Bipartisan Responsible Financial Innovation Act. It addresses the jurisdiction question, stablecoin regulation, Banking, Tax, interagency coordination, and more. Resources: joint Medium post; Press Release.

Senators Toomey and Sinema introduced the Virtual Currency Tax Fairness Act on 26 July. It aims to simplify the use of digital assets for everyday purchases, exempting taxation for small personal transactions that use virtual currencies for services and good. Resources: Bill text; Press release.

Last year’s Infrastructure Investment and Jobs Act created the need for clarification in reporting requirements for digital assets. Senators Toomey, Sinema, Portman, Lummis, and Warner took an important step to clarify the definition of “broker” with respect to digital assets. Resources: Bill text, Press release.

Also on August 3rd, Senators Stabenow and Boozman along with Booker and Thune, released the Digital Commodities Consumer Protection Act. In addition to focusing on commodities, it commissions a report on historically underserved customers to examine the racial, ethnic, and gender demographics of those using digital assets. Resources: Press release, Overview, Section-by-section overview.

What’s next for crypto policy in the US:

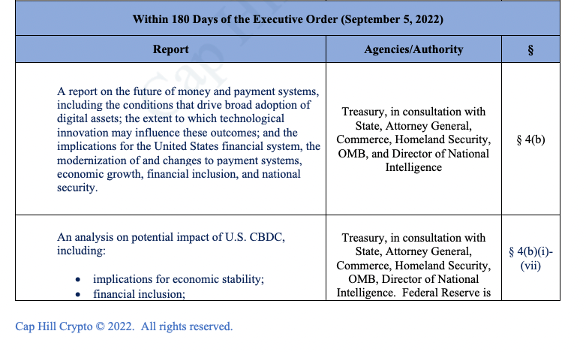

September 5th was the next deadline for reports commissioned by President Biden’s Executive Order on crypto. Expect new analysis on Central Bank Digital Currencies (CBDC), the future of money, the role of law enforcement, the energy transition and economic competitiveness. For a full summary check out Capitol Hill Crypto.

On September 14th, the Senate Agriculture Committee will hold a legislative hearing to examine the bill introduced by Senators Stabenow, Boozman, Booker and Thune and discuss what’s next for crypto policy in the US. The hearing will have two panels, the 1st with CFTC Chairman Rostin Behnam and the second with industry stakeholders, including Crypto Council for Innovation CEO Sheila Warren. The bill would give the CFTC authority to regulate the trading of digital commodities, require all “digital commodity platforms” to register, authorize it to impose user fees on platforms to fund the new authority, establish consumer protections, and require a study on financial inclusion.

After this hearing, Democrats and Republicans from the committee hope to mark up the bill and report it out. At that point, supporters will be looking for a piece of must-pass legislation on which to attach the bill and pass it out of the Senate. Final passage this year would require everything to line up perfectly, but this would be a huge victory for crypto.

The next day, the head of the SEC Gary Gensler will testify before the Senate Banking Committee. We expect him to be asked about everything from regulation by enforcement, climate disclosure, ATS expansion, SAB-121, Administrative Procedures Act (APA), and much more. This hearing will mark the first time Mr Gensler has testified in an oversight hearing in nearly a year – and members on both sides of the aisle will be eager to grill him.

Meanwhile, negotiations on stablecoin legislation are ongoing in the House Financial Services Committee with Chairwoman Waters and Senator McHenry still hoping to mark up a bill before the midterm elections.

The elections are going to come quickly, with the House and Senate barely in for the month of September, and the principal order of business being a continuing resolution that will fund the government until late November or early December. It’s possible that CR negotiations will be complicated by the commitment to Senator Manchin on permitting reform, but the odds are definitely in favor of Congress landing the plane and avoiding a short-term government shutdown.

At some point Congress will act on the National Defense Authorization Act (NDAA), and there is continued discussion of Senate work on competition and privacy legislation.

Practically speaking, all of those are (at best) a lame duck exercise. No one knows just how lame the lame duck will be. There will certainly be a bipartisan push for an omnibus spending bill, with a possible tax sidecar. But the appetite for legislation of that magnitude depends on the attitude of lawmakers after a contentious and unpredictable election cycle.

The Crypto Council will be updating our resource page throughout the autumn on what’s next for crypto policy in the US and abroad.