Summary

- An increasing number of investors and analysts are referring to bitcoin as a ‘macro asset’—an investible asset that responds to or is more sensitive to, broad aggregate economic trends or factors.

- But what exactly does this mean, and which macro factors are the most important when it comes to bitcoin?

- Visit these pages for more explainers and crypto in action stories.

What does ‘macro asset’ mean and why is it important?

The term ‘macro asset’ is widely used and well understood, so this article will not overexplain its definition. However, it is important to more deeply explore why investors should care about bitcoin specifically as a macro asset.

In short, a macro asset is an investible asset that responds to—or is more sensitive to—broad aggregate economic trends or factors. These typically include inflation, interest rates, GDP, or employment.

Investors aim to identify macro assets to either avoid or gain portfolio exposure to certain economic trends. Those in the former group may choose to avoid exposure to hedge against or avoid large macroeconomic trends that they may not have a specific viewpoint on. Those in the latter group might seek exposure to capitalize on trends they believe will develop in the broader economic environment.

A ‘good’ macro asset will move or be sensitive to higher order or larger aggregations of information, rather than microeconomic factors. For example, a stock market index is a better macro asset than specific companies.

What does this have to do with bitcoin? Since there are no cash flows from bitcoin in terms of earnings or dividends, investors do not need to try to estimate the timing and size of future cash flows that could be affected by sales, cost of goods or input prices, operating margins, taxes, or even competitor actions. Instead, bitcoin’s price movements are purely based on changes in supply and demand.

Although this concept may seem trite, the power lies in the simplicity. Since bitcoin lacks company- or issuer-specific factors—and its current and future supply are known and fixed—nearly all price movements can be attributed to changes in demand.

While nearly anything can change bitcoin’s demand in the short term, we hypothesize that in the longer term, two of the biggest drivers of demand come from liquidity in the wider market and inflation expectations.

One of bitcoin’s main value propositions is its fixed supply, which supports its potential to function as a store of value. However, this value must be measured relative to other assets, such as other currencies. As overall liquidity in the economy rises, it can create more opportunities for that liquidity to flow into bitcoin.

Bitcoin’s fixed supply also drives demand from investors and savers looking to protect their purchasing power.

What macro factors could be driving bitcoin?

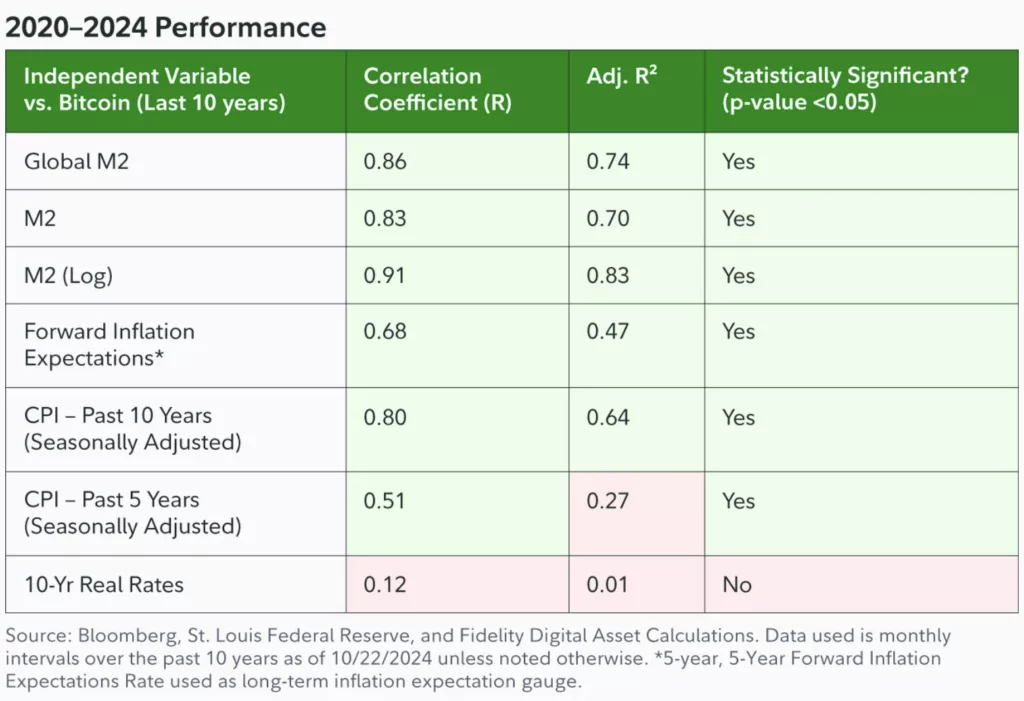

This section explores the hypothesis that liquidity and inflation influence bitcoin. The table below illustrates the results of running a simple statistical test and regression analysis, highlighting the relationship between bitcoin and a handful of the largest macroeconomic indicators.

As a reminder, the correlation coefficient, or R, is the strength and direction of the linear relationship between the macro variable and bitcoin, ranging from -1 to +1. The R-squared is a measure of how much of the variable is explained by the model, which ranges from 0 to +1 and can be expressed as a percentage. The final test is to determine whether the variable is statistically significant (is there a small enough probability that we did not achieve the results by chance?).

All the variables tested below were statistically significant at the 5% level, and all had a positive correlation to bitcoin. However, for the 10-year real rates, the correlation was relatively low and the R-squared was nearly zero, which is addressed later in this article.

Liquidity is in the driver’s seat

The highest measurements in terms of correlation and “best fit” (R-squared) came from liquidity metrics, particularly the broad money supply measures of M2 and global M2.

These results are consistent with our hypothesis of bitcoin as the ultimate macro asset.

It is worth noting that measures of liquidity (M2) have some of the highest positive correlations and highest R-squared values, meaning much of the change in bitcoin’s price can be explained by changes in the money supply. Below we explore whether bitcoin is the best asset to respond to liquidity.

Is bitcoin an inflation hedge?

One key implication of bitcoin’s fixed monetary schedule—especially in a world of increasing money supply that can lead to rising consumer goods prices—is bitcoin’s potential as an effective hedge against inflation.

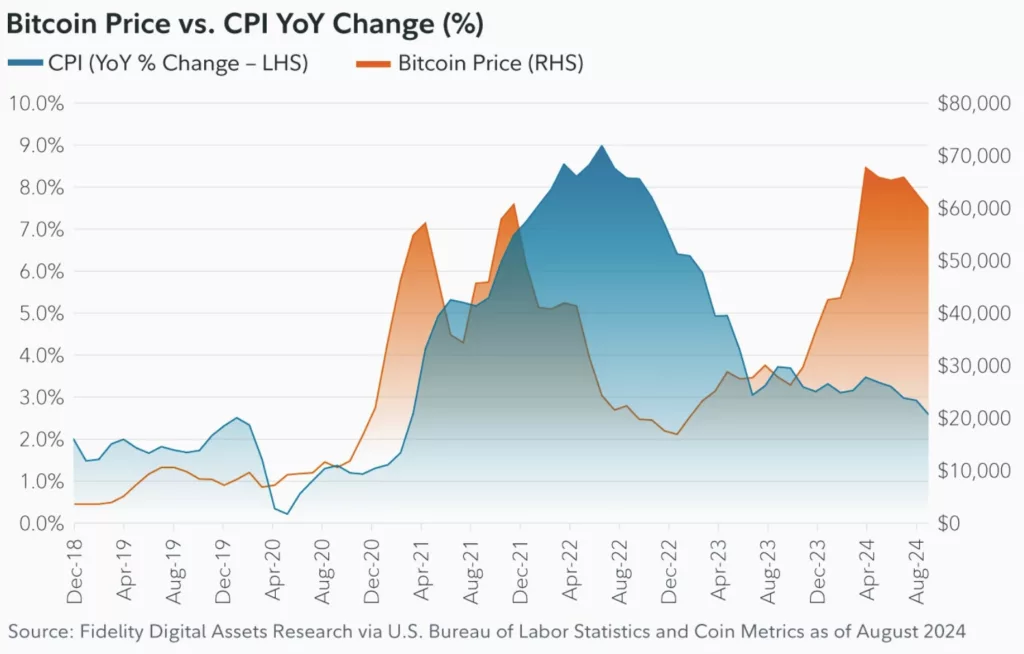

Examining bitcoin with major inflation factors, we see a high positive correlation with the consumer price index (CPI) over the past decade, along with a high R-squared value. However, this correlation has weakened over the last five years. With an R-squared of only 0.27, we see 27% of bitcoin’s moves can be explained by changes in the CPI over the past five years when inflation was particularly high.

This has led many investors to question bitcoin’s viability as an inflation hedge. Skepticism peaked in mid-2022, when the year-over-year change in CPI hit 9%—a level not seen since the high inflation era in the ’70s and ’80s—yet bitcoin was down in excess of 35% year-over-year, testing new lows of $20,000, and even falling lower over the ensuing months. This came just seven months after hitting a new all-time high of nearly $70,000.

However, the consumer price index is a backward-looking metric, measuring the change in consumer prices over the most recent months and comparing it to the year prior. Conversely, bitcoin and other financial markets are forward-looking.

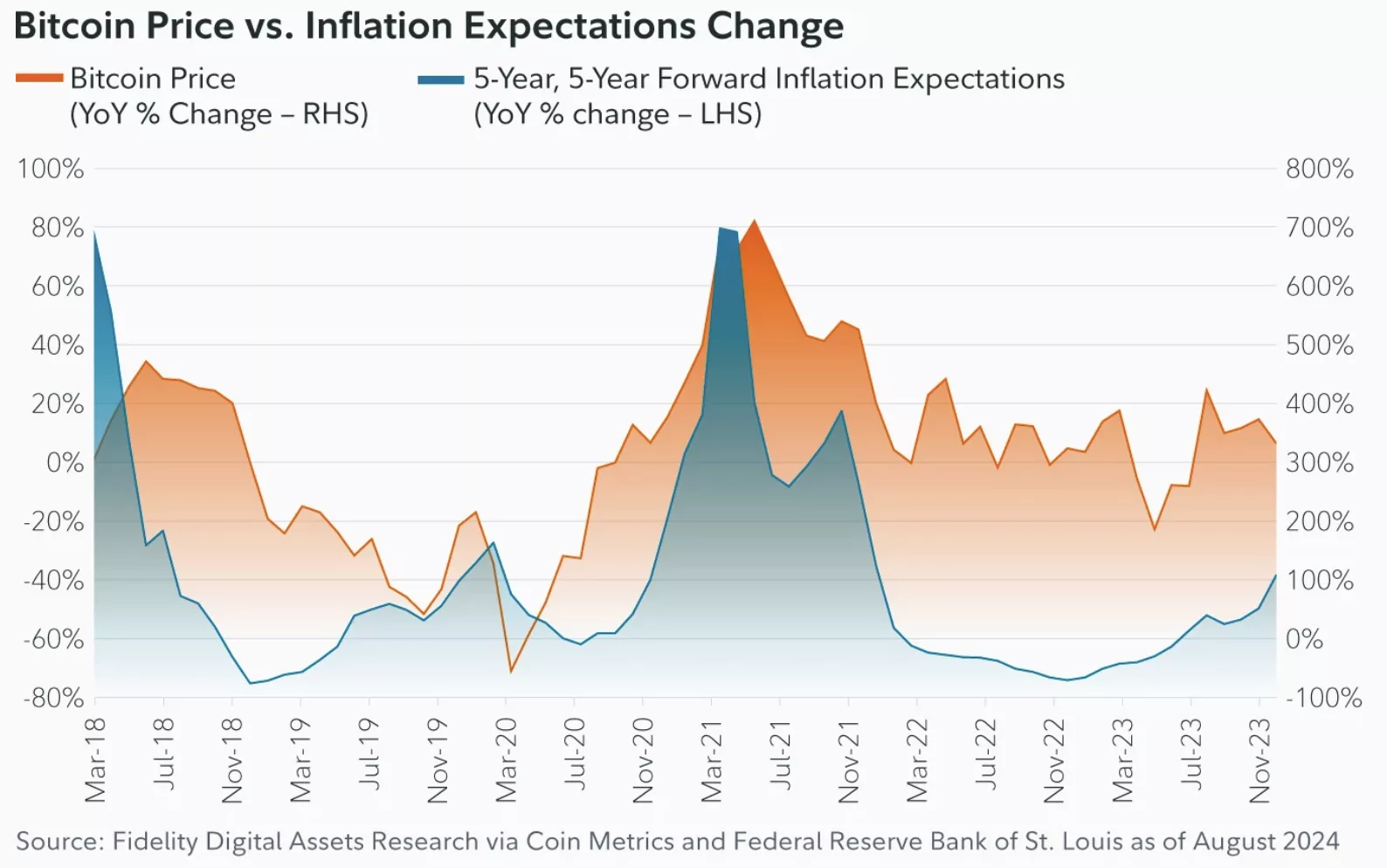

Therefore, we think it is more instructive to examine changes in inflation expectations and see how it compares to changes in bitcoin’s price. When looking at the five-year inflation expectation metric, a forward-looking metric, we see that indeed there is a relatively high and positive correlation along with a moderately high R-squared value.

The following two charts illustrate this concept. The first shows the aforementioned scenario where the CPI hit a 40-year high while bitcoin continued to plummet:

However, this second chart illustrates the correlation to forward-looking inflation metrics, showing that bitcoin rallied over 700% as forward inflation expectations rose 80%. Then, as long-term inflation expectations fell, bitcoin fell along with it.

It is important to note that all these analyses reflect correlation, not necessarily causation. Even with a positive correlation, there are still other factors at play. Nevertheless, we do believe the hypothesis is grounded in sound economic theory, and the real-world tests have yielded expected results.

Unfortunately, as it relates to financial markets, we do not have the luxury of running the same experiment again or controlling for other factors. That said, we will be intently watching to see how bitcoin responds to changes in both liquidity and inflation expectations going forward.

Is bitcoin the most sensitive to liquidity and inflation?

While investors may agree that bitcoin is closely correlated with measures of liquidity and inflation expectations, they might also question whether other asset classes demonstrate similar or greater sensitivity, potentially positioning them as better macro assets.

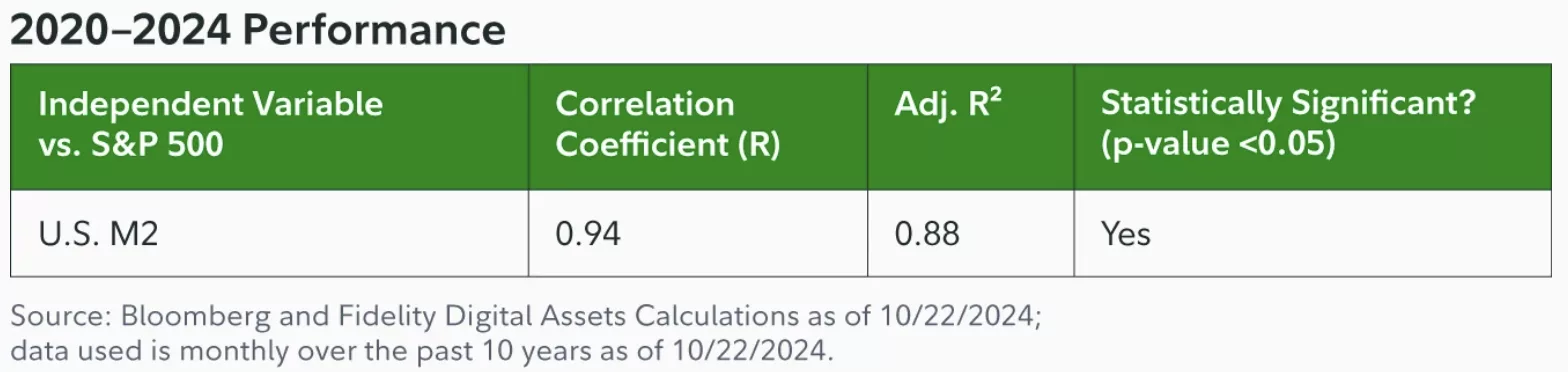

Given this potential concern, we have also examined equities and have found an even stronger relationship (higher correlation coefficient and higher R-squared) with U.S. M2.

Below are the results of the S&P 500 versus U.S. M2 over the past 10 years:

As we can see, the correlation coefficient and R-squared is higher for the S&P 500 and M2 compared to bitcoin and M2, and therefore it may well be that equities are more sensitive to liquidity as it pertains to monetary aggregates.

However, we do note that while both bitcoin and equities have exhibited a high positive correlation to M2, bitcoin has been the “faster horse” or the one that has responded in greater magnitude of returns compared to the S&P 500.

We also note equities may face other risks that bitcoin does not, given their value is derived and dependent on future cash flows. This is not to say one is “better” or “worse” as an investment, but only to point out that bitcoin in this sense may be viewed as more of a “pure” macro asset than equities.

The other factor to consider is that when thinking of a “macro asset,” there are other investment characteristics that may make bitcoin more appealing.

Bitcoin is traded globally 24 hours a day, 7 days a week, 365 days per year across many venues and priced against all major currencies. It is perfectly homogenous with very little transportation and storage costs (leading to very low discrepancies between global markets).

Given the above characteristics, one way to frame bitcoin is as a non-sovereign (not government created, backed, or controlled) currency. This currency also happens to be the “hardest” in history with the lowest inflation rate that cannot be changed and a monetary policy known in advance.

A version of this article first appeared on partner site, Fidelity Digital Assets, in November 2024.