Summary:

- The recently passed Inflation Reduction Act makes historic investments into clean energy investments and tax credits.

- Some $10 billion is available for qualifying projects, which could include crypto data centers.

- Crypto data centers can lead on clean energy and efficiency to contribute to the energy transition.

Further Details:

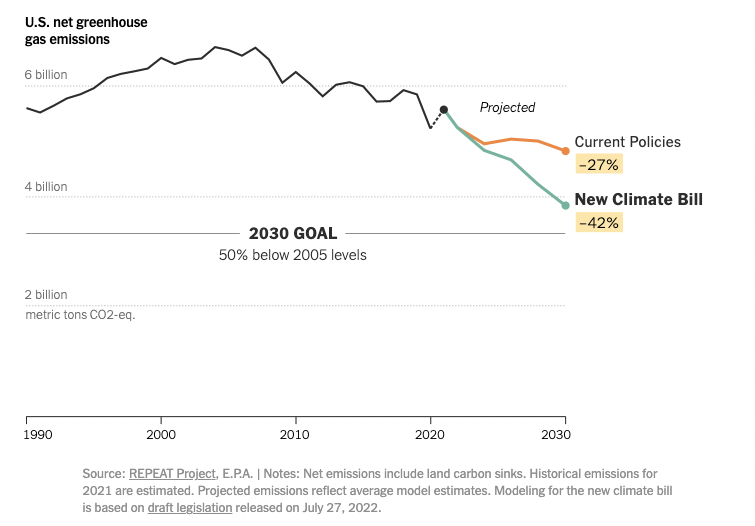

The Inflation Reduction Act of 2022 (IRA) is a $737 billion bill with sweeping implications for many industries, including crypto. The broad and far-reaching legislation addresses pharmaceutical costs, reduces the deficit, and makes historic investments into the clean energy economy. It’s end goal: cutting emissions by 40% from 2005 levels by 2030.

Unprecedented investments – in the hundreds of billions of dollars – will be made into clean energy and carbon capture tax credits to bolster the energy transition. This is an opportunity for many industries including the crypto.

Climate and Clean Energy

Though crypto has come under fire for its energy use, many in the industry are working to leverage its unique properties to support the energy transition to a zero-carbon future. Bitcoin usage represents something around 0.3% of global energy and greenhouse gas emissions. Although this is less than 1% of global usage, the industry is interested in utilizing crypto’s unique properties to support and boost the transition to a zero-carbon future.

Bitcoin developer Satoshi laid out a radical way to secure the network: Proof of Work (PoW), which incentivizes and ensures decentralization. Data centers powering the network use energy as part of this process. This has been a critique, but in fact, the amount of energy required for Bitcoin is leading to more innovation, efficiency, and ultimately, more investment in clean energy.

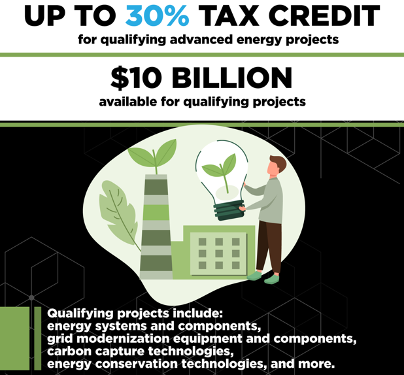

Here’s where the Inflation Reduction Act can be a win-win for the energy transition and for the crypto sector. Large-scale Bitcoin data centers require low energy costs. Bitcoin companies are already making investments in clean energy and energy efficiency. New incentives in the IRA will allow the crypto industry to increase the scale of investments. The Advanced Energy Project Credit is a tax credit up to 30% for a “qualifying advanced energy project.” According to one analysis, qualifying projects include “energy systems and components, grid modernization equipment and components,” carbon capture technologies, energy conservation technologies, and more. The legislation makes $10 billion available for qualifying projects.

Crypto’s Role in the Energy Transition

A big challenge for the renewable energy transition is the mismatch between supply and demand. Crypto, however, can be part of the solution. It can provide a sustained market for renewable energy that might otherwise go to waste or be sold below cost. Crypto data centers are flexible in terms of location and demand. They also offer consistent demand for stranded energy sources, and are inherently transparent.

For example, California curtailed nearly 600,000MWh of renewable power in April 2022 – enough for 55,000 homes for a year. The Crypto Council is working on a report on this issue. It examines case studies of operational data centers powered by renewable or alternative sources to showcase one pathway forward. As the digital asset industry grows around the world, we think it’s important to show some additional pathways forward for how data centers can engage with renewable energy. This is especially important since research has shown that blanket bans can lead to fossil fuel dependence. For example, China’s ban on bitcoin forced data centers powered by renewable energy to migrate to other countries and switch to coal or other fossil fuels.

Many in the crypto sector are looking to power its next phase of growth in lockstep with the goals of the IRA. In emphasizing clean energy projects, crypto can be a key player in the transition to a greener, more energy-efficient future.