Summary

- NFT royalties are crypto payouts designed to proffer creators a cut of secondary sales of their digital collectibles. The percentage of sale designated for royalties is set by the creator at the time of minting.

- The incentive for marketplaces to drop NFT royalties is simple. It attracts traders who want greater profit margins on NFT resales.

- While there appears to be a race to the bottom, the network effects of a single platform’s decision to make royalties optional are limited to the degree of interoperability between NFT ecosystems.

- A version of this article first appeared on Blockworks. Read more Crypto Council explainers.

In an era of artists recouping fractions of a cent on music streams and visual artists lacking any revenue share from the speculative secondary market — NFT royalties were bandied about as a trump card for artists vying to set up sustainable business models.

Now, with the move from X2Y2, Looks Rare and Magic Eden to make NFT royalties optional, artists are once again playing defense.

Because the smart contracts underpinning NFT royalties lack legal enforcement mechanisms or any other outside accountability, it appears the technology is only as good as the platform’s commitment to uphold it.

And, with ImmutableX’s swift launch of a community-managed NFT marketplace blacklist, scores of skeptical artists and NFT collectors have been asking how the tech actually works — and if artist royalties can be saved.

What are NFT royalties?

NFT royalties are crypto payouts designed to proffer creators a cut of secondary sales of their digital collectibles. The percentage of sale designated for royalties is set by the creator at the time of minting — typically around 6%. Smart contract platforms where NFTs are minted are, in most cases, responsible for automating the payments.

The key to the success of revenue sharing lies in previous attempts to institute universal baselines for artist resale royalty rights. It explains why NFT royalties matter to the Web3 narrative and where the system currently falls short of its intended purpose.

Why artists need resale revenue

Artists have long struggled to find fair compensation. Artists such as Harvey Ball, famous for creating the yellow smiley face in 1963, was only paid $45 for his iconic image. The t-shirt company that used it later sold for $500,000,000 in 2000. And Robert Rauschenberg in 1958 sold his painting “Thaw” for $900. Just a few years later it changed hands for $85,000.

Once the intellectual property of both artists left the building, they lost all rights to downstream payments. That would not be the case if they had rights to royalty payments from secondary sales.

Resale royalty rights are the legal entitlement to a percentage of proceeds made from selling an original artwork. The right is either granted by the state or a contract between the artist and reseller. And in the US, save for California, artists can only access this right through individual contracts.

In 2013, The United States Copyright Office reported that visual artists are at a unique disadvantage compared to other creators when it comes to revenue generation.

Because the value of their art is derived from uniqueness, little money can be made from reproduction. The inherent nature of visual art excludes it from the type of royalty contracts between musicians, record labels and streaming platforms.

The music industry has its own set of challenges when it comes to fair compensation. The streaming model has cut artists out of a large share of royalties. Projects such as Blocktones have found creative ways to royalties into their music based NFTs.

Artists in the US have attempted to institute universal baselines for artist resale royalty rights through legislation, but each attempt has failed. And while some of these rights exist for Californians — and in some countries such as France — the requirements are easy to evade due to the lack of cross-border enforcement.

The ability to offer artists an easy system to collect royalties from NFT resales is what convinced many artists to enter the NFT market. Without royalties, the technology lacks an alternative to the artist’s monetization model.

How NFT royalties work

The NFT royalty system can differ between blockchains, but with Ethereum, it is managed at the discretion of smart contract platforms.

With Rarible, for example, the artist can set the percentage of resale proceeds at the minting stage via a smart contract on the blockchain in question. At the time of purchase, the platform automatically executes the terms of the contract. Platforms differ in the specifics of payout schedules.

The terms do not represent a legal contract, though — typically in a bid to sidestep litigation.

Case in point: Per Rarible’s terms of service, creators must agree to grant the platform royalty-free rights to any content posted on the platform. So, even though the platform embeds the terms of royalties via smart contract, there is no legal obligation.

The legalese transfers the enforcement burden from civil authorities to code. But, because the automation still requires consent from the market maker, a series of thorny enforcement challenges have emerged.

Can you transfer royalties between marketplaces?

Royalty policies from other platforms do not automatically transfer.

OpenSea, for instance, only supports royalties on collections — not individual pieces. So, if an NFT with its own royalty policy is sold on Rarible, and then listed on OpenSea, the original artist would not see any revenue from the secondary sale. Additionally, OpenSea’s maximum royalty is 10% to Rarible’s 50%.

What are optional royalties?

NFT marketplaces such as LooksRare, Magic Eden and X2Y2 have all moved away from the NFT royalty model. Their new royalty-optional system lets NFT buyers decide to honor an artist’s royalty policy for purchases.

How? Well, even though royalties policies are immutable smart contracts, the Ethereum blockchain isn’t able to enforce stipulations on token transfers. Any enforcement of the smart contract is inherently voluntary. The platforms simply passed that option on to the buyers.

This means that for all existing and new NFT listings, royalty payments are discretionary. Some platforms including LooksRare have agreed to share 25% of protocol fees with creators in an effort to alleviate the effects to the artist revenue model.

NFT artists like Tyler Hobbs have started adding NFT marketplaces that evade royalties to a blacklist.

He added X2Y2 to the blacklist in his QQL collection following their decision to axe royalties. The move succeeded in blocking the collection from being listed, but platforms can develop workarounds. Some ecosystems such as ImmutableX are working on a community-managed whitelist and blacklist that would implement broad enforcement across the Ethereum NFT ecosystem.

Is there evidence that NFT royalties offer sustainable revenue to artists?

During the early days of NFT launches, many projects and individuals generated millions from royalties on the secondary market. Today, the secondary market is not providing the same.

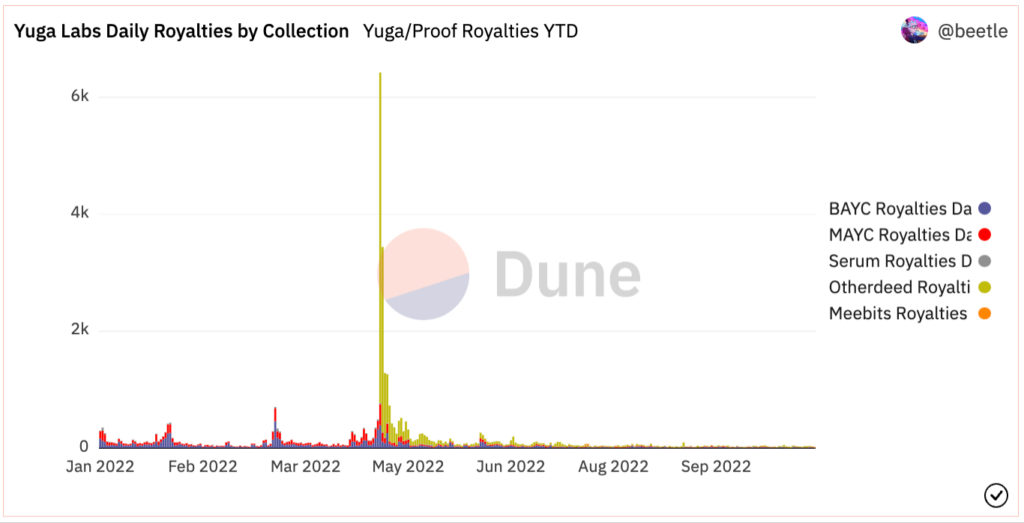

Bearish market conditions combined with a growing number of platforms abandoning royalties have all contributed to declining revenue. A look at Yuga Labs’ royalty payouts illustrates this decline:

Many projects have shut down. But NFT collections such as DeGods have responded by removing royalties outright.

DeGods launched a collection of 10,000 Solana NFTs in October 2021. The project adds utility beyond the resale market by giving DeGods and DeadGods NFT holders the ability to stake and earn utility tokens.

While large projects with outside revenue sources can afford royalties, individual artists cannot. To illustrate, the NFT collection Fidenza by Tyler Hobbs has made a total of 3,999 ETH in royalty revenue, according to Flips.Finance. The initial mint price was only .17 ETH, meaning royalty revenue exponentially outweighed mint proceeds.

Despite enforcement challenges, resale royalties have a major impact on an artist’s bottom line.

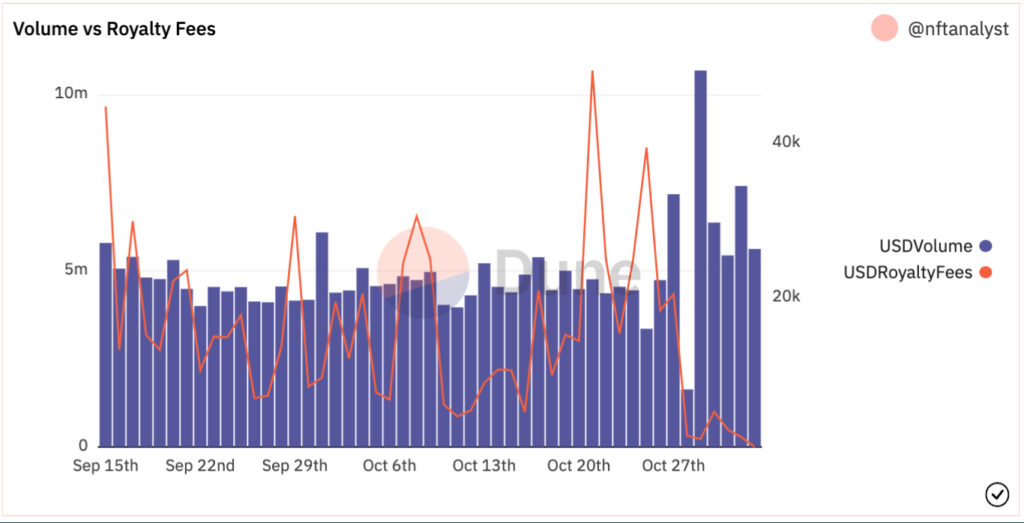

If an NFT transferred from OpenSea to LooksRare, the artists could still see royalties if the artist registered the collection. But as soon as LooksRare made royalty payments optional, the platform’s total volume rose dramatically, and royalty fees dropped close to 0.

The economics driving NFT marketplaces to drop royalties

The incentive for marketplaces to drop NFT royalties is simple. It attracts traders who want greater profit margins on NFT resales.

“Right now, we’re seeing some marketplaces looking for an edge during the current NFT market downturn, and they’re turning to tactics like eliminating mandatory royalties,” MakersPlace CEO Craig Palmer said in a statement. “MakersPlace has always been a firm supporter of creators and while this ‘optional’ approach where the buyer decides whether or not to pay royalties may make sense to other marketplaces, it doesn’t fit with our vision for the space.”

In addition to MakersPlace, NFT marketplaces such as Rarible and OpenSea are continuing to enforce royalties.

In response to Magic Eden and LooksRare transitioning to optional NFT royalties, Twitter user NFTstatistics.eth explained the economics in action.

While there appears to be a race to the bottom, the network effects of a single platform’s decision to make royalties optional are limited to the degree of interoperability between NFT ecosystems.

Because Magic Eden supports both Solana- and Ethereum-based NFTs, the marketplace’s move to drop royalties incentivizes marketplaces in both blockchains to follow suit.

While the trend has grown across both blockchains, it has not yet triggered a similar pattern across NFT economies on the likes of Cardano.

Cardano NFT volume surpassed Solana’s for the month of October, with some speculating demand for royalties as a large reason why. The theory: The artist-friendly setup attracted a new wave of artists and mints.

The future relationship between artists and NFTs

According to critics of optional royalties, this race to the bottom is a desperate attempt to keep users engaged. Yet, it robs Peter to pay Paul in the sense that benefits to traders come at the expense of the artist.

The royalty incentive only works when all major platforms agree to uphold them. If one breaks that disagreement, it’s not long before others follow.

The industry appears to be at a fork in the road. If it finds a way to enforce royalties at the protocol level — or even a legal level — then it may succeed where lawmakers failed.

But most proposal upgrades appear to have loopholes that would allow for similar problems to emerge.

The alternative is to find a different carrot. If NFTs succeed in implementing a sustainable business model without royalties, others may follow.