Summary

- A DAO, or Decentralized Autonomous Organization, is an internet-native, or web-based entity built on blockchain technology and governed through smart contracts and its token holders.

- Token holders in DAOs are the primary decision-makers and employ various voting methodologies. This aims to ensure fair representation, prevent centralization, and ensure alignment with the DAO’s goals.

- Unlike traditional organizations, DAOs are decentralized entities without a central authority and operate with transparent on-chain voting through governance.

- The regulatory environment around DAOs remains to be determined, posing challenges in jurisdiction, securities laws, anti-money laundering, taxation, and consumer protection.

- Read more Crypto Council explainers.

What is a DAO?

A Decentralized Autonomous Organization (DAO) is an entity organized online with blockchain technology. Core team members of a project write rules and set the foundation of a DAO. These rules are written with smart contracts and enforceable through governance. These smart contracts are verifiable and publicly auditable, bringing transparency about how the organization is working to members and outsiders. Governance is a cohort of tokenholders who can submit and vote on proposals to make rule changes without relying on a centralized authority. Although most DAOs have similar structures, each has unique functions and parameters that can change through this governance process.

A simple explanation of a DAO

Picture a Book Club where members can propose and vote on ideas for new rules. Once most members approve a rule, it gets added to the Book Club’s constitution. This constitution is a computer program that automatically executes the rules purely based on the outcome of a vote without any additional intervention.

For example, a rule could be: “Use 1% of monthly dues to fund beverages during meetups.” Programmatically, a 1% allocation of funds will be made for beverages and accessible by an agreed-upon cryptocurrency wallet.

Members manage the club transparently through proposals and votes that are visible and accessible to everyone. Rules are enforced automatically via code and run autonomously through a member-governed, rule-based system known as a DAO.

How DAOs it Work?

Core team members and collaborators often discuss and determine what they want to achieve with a DAO. They help structure a framework that ensures alignment in governance and establishes a voting methodology. Identifying methods of capturing protocol revenue to grow the treasury is also essential in funding the advancement of a protocol’s growth strategy and long-term continuity.

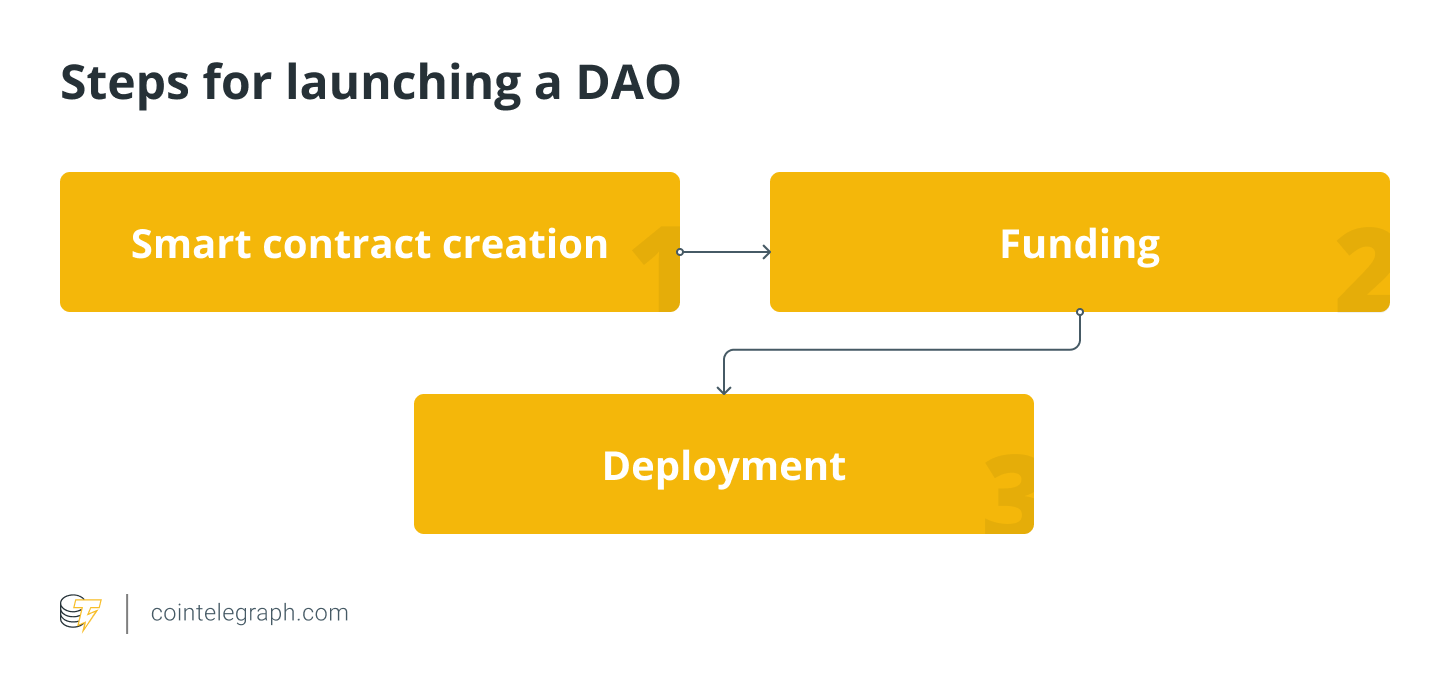

There are a few steps involved in launching a DAO, which include the following:

- Smart Contract Creation

Core team members and collaborators are instrumental in setting the rules for how the DAO will function at inception, its infrastructure, the DAOs rule set, and the underlying protocol’s upgradeability moving forward. Following the creation of a smart contract, rule changes must go through the governance system.

- Funding

Following smart contract creation, the DAO typically raises funds through token sales, distributing DAO voting rights. In other cases, users who provide liquidity to the new protocol could be eligible for rewards denominated in the native governance token.

- Deployment

The DAO structure goes live after deploying the smart contract on a blockchain. Tokens and token rights are then distributed based on the funding schedule.

Token holders in a DAO represent voting shares allowing them to submit and vote on proposals. There are various types of voting mechanisms, some of which include Plurality, Quadratic, and Voter staking.

- Plurality Voting – The proposal with the most votes wins

- Quadratic Voting – Voters have a limited budget of votes, and the cost increases quadratically per extra vote. (e.g., two votes cost four tokens; 2^2)

- Voter Staking – The number of tokens staked determines the votes weight

DAOs can leverage different voting methods to balance engagement, prevent centralization, and align the protocol’s and its members’ incentives. Token holders collectively steer the DAO by exercising their voting power on which proposals they want to accept and implement in a fully transparent and decentralized manner.

For example, DAOs can propose and vote on adjusting a fee capture mechanism which could accrue more value to a treasury controlled by the DAO.

Organizational Structures and Functions

DAOs differentiate from traditional organizations in their ownership, governance, and operations approach. DAOs offer tokenized ownership, utilize transparent on-chain voting, govern through rigid code, abstain from hierarchical control, and maintain blockchain-based transparency.

In contrast, traditional organizations have centralized equity ownership, more opaque governance processes, flexible bylaws, hierarchical management structures, and selective disclosures. DAOs emphasize decentralized, trustless coordination, while traditional entities rely on centralized control and hierarchies.

The DAO Behind the DAI

MakerDAO, established in 2015, stands out as one of Ethereum’s earliest DAOs, introducing a decentralized cryptocurrency-backed stablecoin called DAI. Users can deposit eligible collateral (e.g., ETH) in exchange for a loan denominated in DAI supported by collateral ratios. MKR token holders govern these ratios. Additionally, the MakerDAO has instituted various mechanism upgrades, such as imposing fees on DAI-denominated loans to safeguard its peg and initiating automated auctions of collateral assets amid market fluctuations.

A DAO Did What?

In November 2021, a phenomenal demonstration of the power and reach of decentralized finance, a group known as ConstitutionDAO drew significant attention for its bid to acquire one of the 13 surviving copies of the original U.S. Constitution from Sotheby’s auction house.

Originating from an idea by two Atlanta-based finance professionals, the endeavor rapidly garnered attention through social platforms, rallying support from over 19,000 members. Within a week, the ConstitutionDAO raised over $40 million in Ethereum (ETH). However, the group failed to win the bid, losing to billionaire Citadel CEO Ken Griffin. They later revealed that they needed to gather more funds to ensure the long-term care of the document. After failing its bid, funds were returned to participants. Despite its defeat, this exercise serves as a testament to the potential of DAOs in mobilizing community efforts and resources, emphasizing shared ownership, transparency, and swift decision-making.

DAO Regulatory Framework

Regulation around DAOs still ventures into the unknown, primarily due to their decentralized nature and unique operational model, which challenges traditional regulatory frameworks. A broad overview of the current regulatory landscape:

- Jurisdiction: The global and decentralized attributes of DAOs raise questions regarding which regulatory bodies have authority over them.

- Securities Laws: The structure and operations of certain DAOs might classify them as securities, subjecting them to relevant regulations. The U.S. SEC has yet to provide definitive guidelines on this matter.

- Anti-Money Laundering (AML): DAOs facilitating pseudo-anonymous transactions could violate AML laws. However, enforcing these laws can be complicated.

- Taxation: Ambiguities surrounding the categorization of DAO tokens (securities, commodities, or collectibles) lead to tax uncertainties.

- Consumer Protection: Some DAO operations may be obligated to adhere to consumer protection statutes, but holding a decentralized entity accountable is problematic.