The latest Crypto Council infographic outlines measures for managing illicit finance risks across each layer of the crypto technology stack. Contrary to popular belief, the crypto ecosystem is not a “Wild West” characterized by lawless behavior.

With the publication of this visual guide, the Crypto Council hopes to foster a deeper understanding of the roles that various actors and tools play in maintaining the security and compliance of the crypto landscape. The measures and tools in this guide are not exhaustive, but are intended to showcase some of the innovations and technology-tailored solutions in a vibrant and fast-moving ecosystem.

Download the guide

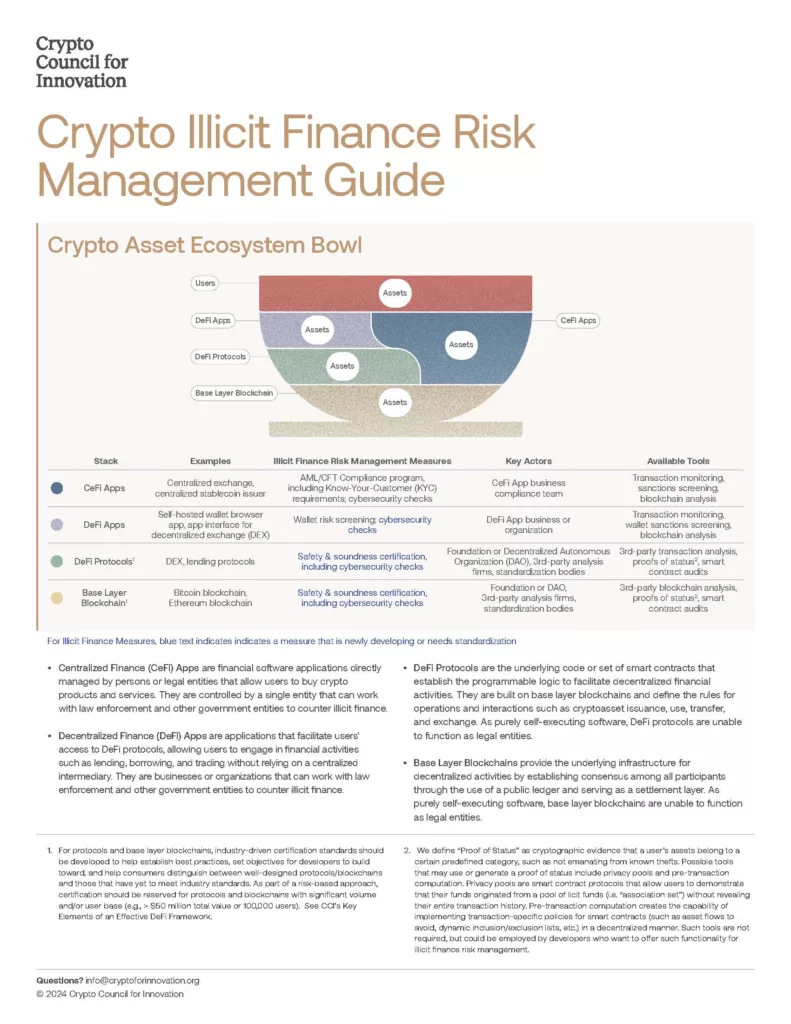

The infographic serves as an educational resource for policymakers and other stakeholders, highlighting industry best practices and emerging solutions for Centralized Finance (CeFi) apps, Decentralized Finance (DeFi) apps, DeFi protocols, and base layer blockchains such as Bitcoin and Ethereum. It also outlines the available tools that key actors can use to implement the risk management measures. This guide builds upon the Crypto Council’s white paper on DeFi regulation, “Key Elements of an Effective DeFi Framework,” published last fall.

The infographic breaks down into a few sections:

Illicit finance risk management measures for CeFi apps involve Anti-Money Laundering/Countering the Financing of Terrorism (AML/CFT) compliance programs, including Know-Your-Customer (KYC) requirements and cybersecurity checks.

DeFi apps are user-facing applications that facilitate access to DeFi protocols, allowing users to engage in financial activities such as lending, borrowing, and trading without relying on a centralized intermediary. Illicit finance measures for this layer include wallet risk screening and cybersecurity checks.

DeFi protocols and base layer blockchains provide the underlying infrastructure to support decentralized financial activities. DeFi protocols are self-executing software that establish the programmable logic for operations such as cryptoasset issuance, use, transfer, and exchange.

DeFi protocols are built on base layer blockchains, which serve as the settlement layer and establish consensus among decentralized participants through the use of a public ledger. Illicit finance risk management measures for DeFi protocols and base layer blockchains include safety and soundness certification, a concept that was first introduced in the “Key Elements” white paper.

Yaya Fanusie, the Crypto Council’s Director of Policy for AML and Cyber Risk presented this crypto illicit finance risk management guide at Europol’s Virtual Currencies Conference today in the Hague.

Download the Crypto Illicit Finance Risk Management Guide infographic.