Summary

- This blog series will breakdown what you need to know about the upcoming European elections and what their impact could be on the crypto industry.

- The series will also cover how Europeans go to the polls, how European Parliament is formed, and how EU countries view crypto.

- The results of the European Parliament elections shape not only the make-up of the incoming European Commission (EC), which acts as a sort of executive in the EU, but also future EU policy, including crypto.

- Read more CCI explainers.

What is the European Parliament?

The EP represents the citizens of Europe in EU processes. It is the only directly elected EU institution and forms one-half of the EU’s ‘co-legislator’ (alongside the Council of the EU, which represents EU countries (also known as its Member States)).

The first direct elections were held in 1979; since then elections have taken place every five years. This year marks the 10th legislative period and will see EU citizens using a form of proportional representation to elect 720 Members of the European Parliament (known as MEPs) from the EU’s 27 Member States.

The EP is perhaps the EU institution that has gained most power over the course of the EU’s evolution, with increasing powers being transferred to EU level, and with the ‘ordinary legislative procedure’ (colloquially known as ‘co-decision’) becoming the norm for most policy areas. The exceptions to this are foreign and defense policy and taxation, with the EP role limited in the former and merely a consultation in the latter.

How is the European Parliament formed?

Most MEPs sit in political groups in the EP. A total of 23 members are needed to form a political group, representing at least one-quarter of the Member States (meaning a minimum geographical coverage of at least seven Member States). The out-going parliament has seven groups, spanning the political spectrum. There are also independent MEPs, who sit outside these groups. There are, however, advantages to being in a group, not least access to funds, more speaking time in parliamentary sessions and a role in drafting legislation.

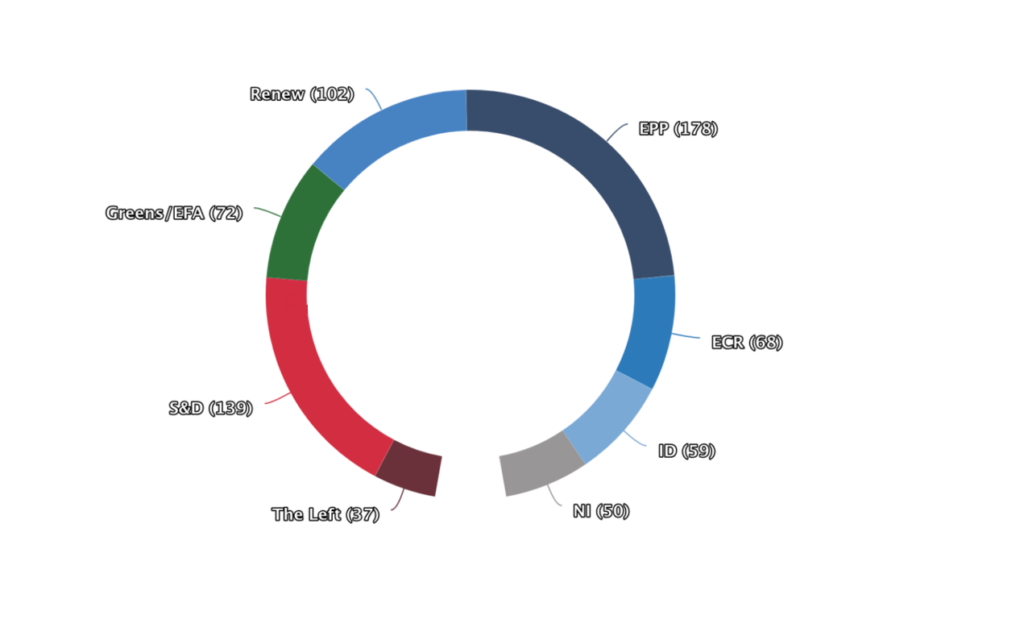

Source: Image showing Members by Group, courtesy of the European Parliament.

Currently, the largest group is the center-right, Christian Democrat European People’s Party (EPP), which comprises 178 of a current total of 705 MEPs, while the smallest party is the Left with 37.

The other groups are:

The center-left Socialist & Democrat group, which has 139 MEPs.

The liberal Renew Europe group, which currently has 102 members.

The Greens/European Free Alliance group, which currently has 72 members.

The European Conservative and Reformist (ECR) group, currently registering 68 MEPs.

The Identity and Democracy (ID) group, a growing but disparate group of nationally-focussed parties, such as Rassemblement National (France), which has 59 MEPs.

MEPs are members of parliamentary committees, of which there are 20. These bodies draw up the EP’s position on legislation in relation to its competence. They are also members of delegations, which see MEPs maintain dialogues with dialogue partners from the rest of the world (also known as ‘third countries’).

Which EU parliamentary committees are important to the digital assets and crypto?

There are a number of parliamentary committees that cover issues relevant to the sector, including the Committee on Economic and Monetary Affairs (ECON), the Committee on Industry, Research and Energy (ITRE), Committee on the Internal Market and Consumer Protection (IMCO), Committee on Civil Liberties, Justice and Home Affairs (LIBE) and Committee on Legal Affairs (JURI). The most active in the digital assets and crypto space is ECON.

The make up of the EP and its committees is important to future digital assets/crypto policy because MEPs play a large part in shaping and adopting legislation.

The outgoing EP has undertaken a significant legislative programme of relevance to the crypto/digital assets community. The most high profile and directly relevant file has been the Markets in Crypto Assets Regulation (MiCA), which provides a legislative framework for stablecoins (applicable as of end of June 2024) and exchanges known as crypto service asset providers (CASPs) (applicable as of December 2024).

Other noteworthy initiatives include the Transfer of Funds Regulation – the EU’s implementation of the FATF travel rule – the Data Act, which includes provisions relating to smart contracts for data sharing, the anti-money laundering (AML) package and rules on a European digital identity. None of these pieces of legislation would be possible without the approval of the EP, underscoring just how important the institution is to the development of EU crypto policy.

Further reading: the EP provides insights, including a snapshot of the current EP, significant trends and the EP’s structure.